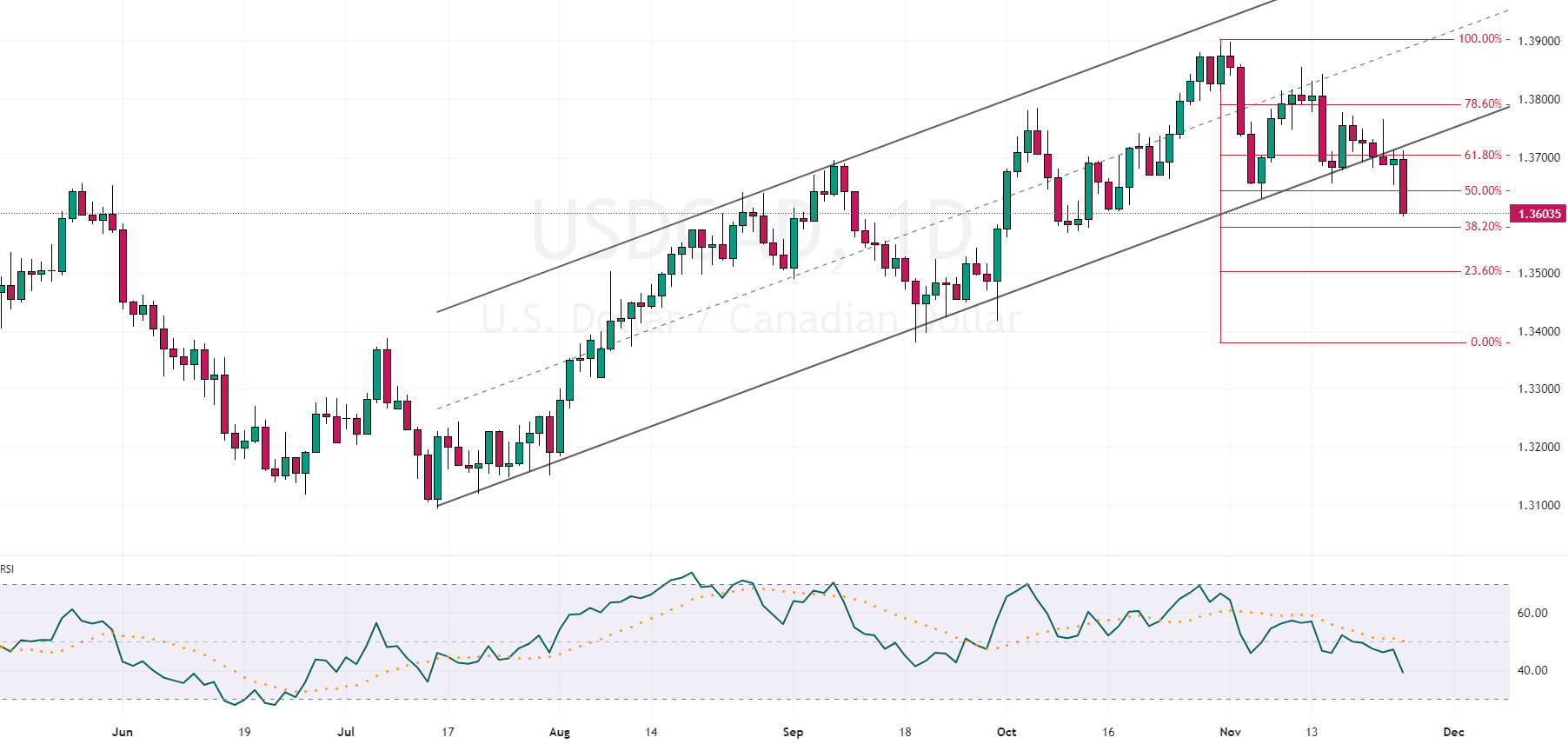

USDCAD Analysis – November-24-2023

FxNews — In late November, the Canadian dollar (CAD) experienced a noticeable upswing, reaching around 1.37 per US dollar (USD). This improvement is a recovery from its near one-year low of 1.386, which hit on October 31st. One significant factor contributing to this rebound is the softening of the US dollar, influenced by the Federal Reserve’s (Fed) apparent conclusion of its policy of increasing interest rates, commonly known as the Fed’s tightening campaign.

Impact of Domestic Factors

On the domestic front, Canada’s inflation rate in October dipped to 3.1%, a decrease more substantial than anticipated. This rate was also lower than the Bank of Canada’s (BoC) prediction, which was around 3.5% through the middle of next year. This decline in inflation, often termed disinflation, suggests a gradual decrease in the rate at which prices for goods and services rise. When coupled with the signs of a slowing economy, these factors lead to increased speculation that the BoC might hold off on further hikes in interest rates.

Economic Implications

The current trends in the Canadian dollar and domestic economic factors offer a mixed bag of implications for the economy. Easing inflation and stabilizing the currency are positive signs, indicating a potentially more balanced economic environment. However, the slowing economy and speculation about the BoC’s interest rate decisions suggest caution and uncertainty about future economic growth.