USDCAD Analysis – 20-June-2024

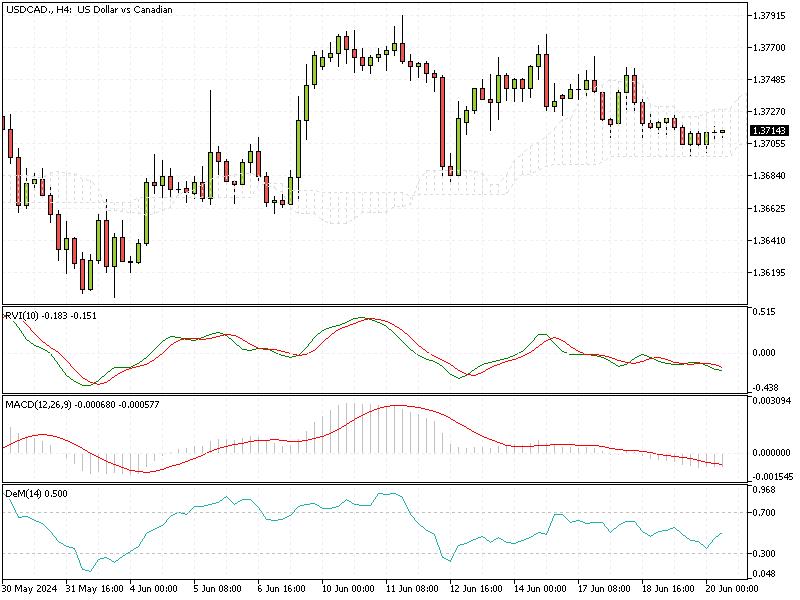

USD/CAD—The Canadian dollar (CAD) trades around 1.371 per USD, rebounding from a five-week low of 1.376 observed on June 7th. This shift comes as the US dollar weakens and foreign currency inflows into Canada increase.

The decline in the US dollar can be attributed to disappointing retail sales figures for May and downward revisions for April’s data. These indicators point to an economic slowdown in the US, leading to growing expectations that the Federal Reserve will implement two interest rate cuts this year, potentially starting in September.

USDCAD Analysis – 20-June-2024

USDCAD Analysis – 20-June-2024

At the same time, oil prices have reached seven-week highs, driven by summer demand optimism and rising geopolitical tensions. Higher oil prices generally benefit the Canadian economy, which is a significant oil exporter, thus attracting more foreign currency inflows and supporting the loonie’s value.

However, the Canadian dollar is also facing challenges. Rising debt levels within the country are a concern, and recent comments from the Bank of Canada (BoC) Governor, Tiff Macklem, suggest the possibility of further rate cuts. If these cuts occur, they could put additional downward pressure on the CAD.

For those watching the currency markets, it’s crucial to consider these factors. The interplay between US economic data, Federal Reserve policies, and global oil prices will significantly influence the Canadian dollar’s trajectory in the coming months.