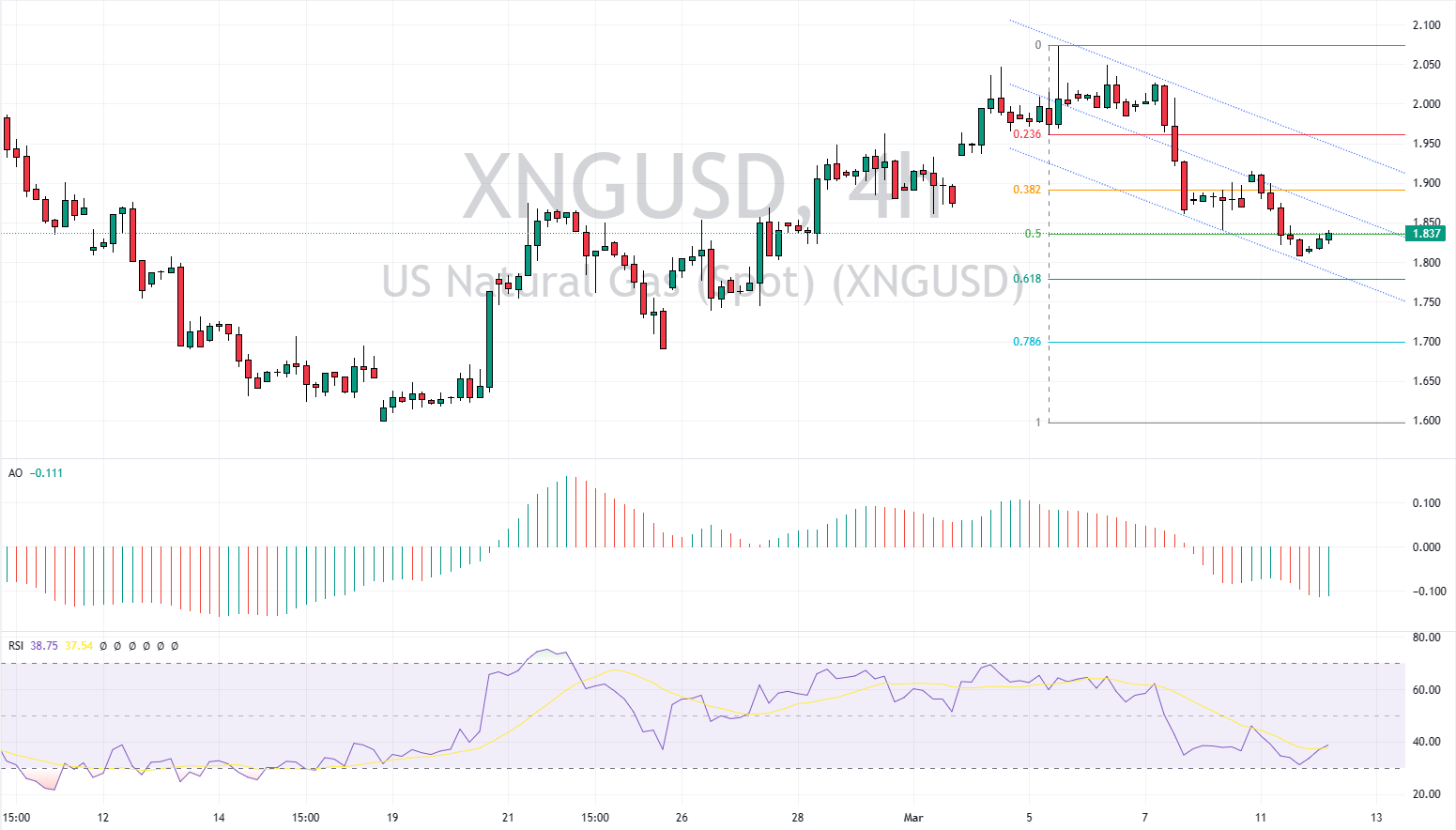

U.S Natural Gas Analysis – March-12-2024

The recent dip in the price of US natural gas, which fell to below $1.77 for each million British thermal units (MMBtu), is a significant development. This is the lowest it’s been in two weeks. The drop is primarily due to decreased gas going to places where it’s turned into liquid natural gas (LNG) for export.

Additionally, the weather forecast indicates warmer-than-usual temperatures for the next two weeks. This milder weather leads to reduced heating usage by people and businesses, lowering the demand for natural gas. The Freeport LNG plant, in particular, has been using about half as much gas as it usually does, as one of its processing units is shut down.

Challenges in Natural Gas Operations and Production Cuts

The Freeport LNG plant, which is expected to resume operations this week, is still experiencing significant disruptions. The shut-down unit, Train 3, is causing the plant to operate at a much lower capacity than usual. This suggests they are encountering difficulties in getting it back up and running.

Weather experts predict that the warm weather will persist until March 18, followed by a potential excellent spell until March 26. Meanwhile, major energy firms like EQT and Chesapeake Energy have been reducing gas production in response to the price drop in February.

Natural Gas Inventory Levels: A Buffer Against Demand

Despite the decreased production, the natural gas industry has a significant buffer in stored gas. The latest report from the Energy Information Administration (EIA) reveals that there is about 30.9% more gas in storage than expected around this time of year.

This surplus in storage can help ensure a steady supply even if demand increases or there are more issues in gas extraction. This stockpile acts as a cushion, crucial in stabilizing prices and guaranteeing sufficient gas for homes and businesses, even in the face of unexpected weather or production changes.