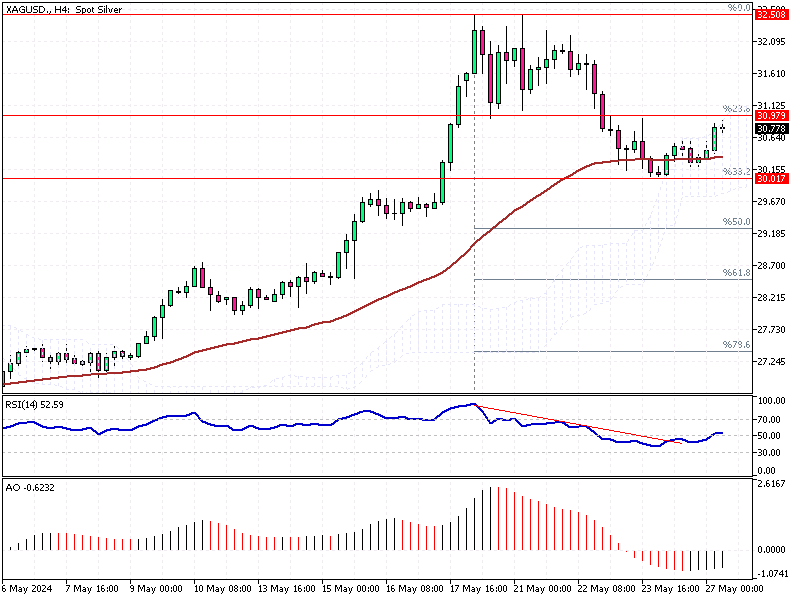

Silver Prices Hold Steady Near $30 – What’s Next?

Silver prices have steadied around $31.7 per ounce. This follows a peak, the highest since December 2012, as investors digest the latest comments from Federal Reserve officials.

Silver Prices Hold Steady Near $30

Fed Vice Chair Michael Barr and Atlanta Fed President Raphael Bostic recently shared insights on the monetary policy outlook. Barr stressed the need for more time to gauge policy effectiveness, while Bostic expects only one rate cut this year. High interest rates typically reduce the appeal of non-interest-bearing assets like silver.

Silver’s Industrial Demand

Silver remains strong due to its industrial uses despite the pressure from interest rates. This demand aspect helps maintain its value, even in a high-interest environment.

Silver Supply Deficit

A fourth-year supply deficit supports silver. Stockpiles tracked by the London Bullion Market Association hit their second-lowest level in April. Meanwhile, New York and Shanghai stock levels are near their seasonal lows.

What This Means for Traders

Understanding these dynamics is crucial for traders and investors. Silver’s industrial demand and supply constraints are key factors that could keep prices buoyant despite broader economic pressures.