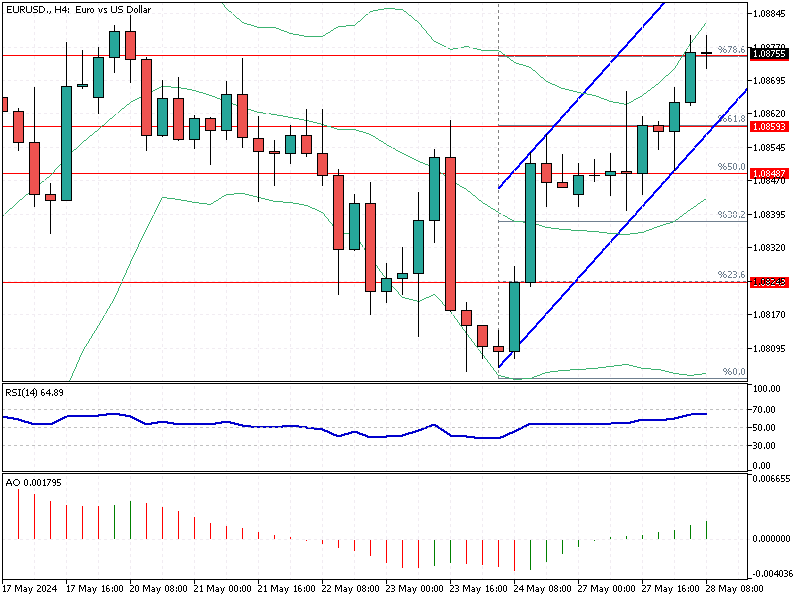

EURUSD Analysis – May-28-2024

EURUSD Analysis—The Euro climbed to $1.085 in the last week of May, approaching the highs seen earlier in the month. This rise comes as traders adjusted their expectations for interest rate cuts.

EURUSD Analysis – May-28-2024

Bloomberg—Investors now predict an 88% chance that the European Central Bank (ECB) will reduce rates during its upcoming monetary policy meeting. However, doubts linger about further cuts beyond June, with expectations now focusing on just one more reduction this year.

The ECB’s Chief Economist recently mentioned to the Financial Times that while the central bank is prepared to cut interest rates in June, the policy needs to remain restrictive. Wage growth, a key economic factor, is not expected to normalize until 2026.

Surge in Wage Growth

In the first quarter, negotiated pay surged 4.7% compared to a year ago, nearing record levels from Q3 2023. This increase highlights ongoing inflationary pressures that the ECB aims to manage.

Private Sector Activity Growth

The latest PMI readings indicated significant growth in private sector activity in May. Faster increases in new orders and employment contributed to the most robust expansion seen in a year.