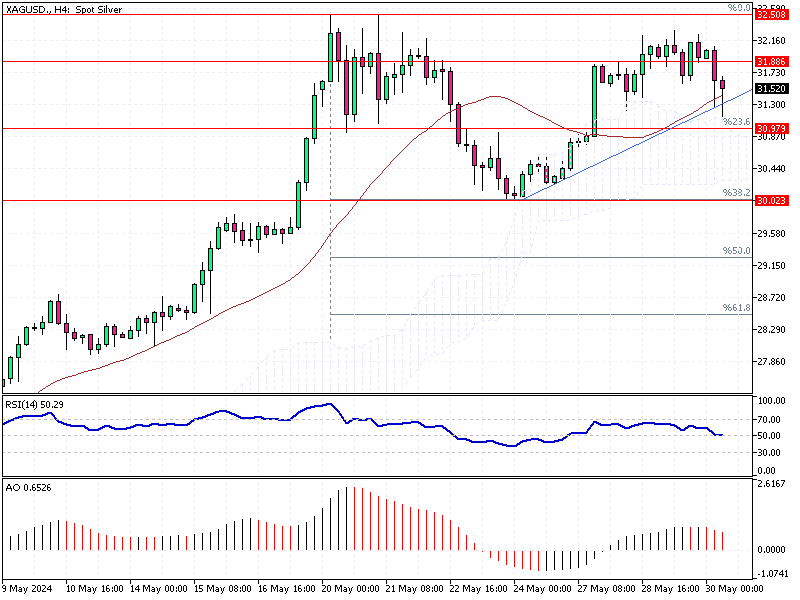

Silver Analysis – May-30-2024

Silver prices have surged to $32 per ounce in late May, reaching their highest level in 11 years. This impressive performance is mainly due to strong industrial demand and a favorable economic climate for precious metals.

Silver Analysis – May-30-2024

Silver Analysis – May-30-2024

Despite robust economic growth and persistent inflation in the US delaying expectations for monetary easing, markets still anticipate multiple rate cuts from the Federal Reserve this year. Similar expectations are held for the European Central Bank, the Bank of England, and the People’s Bank of China.

These potential rate cuts reduce the opportunity costs of holding bullion, driving more interest in precious metals from central banks. As a result, silver has seen a remarkable 40% increase in the second quarter.

Industrial demand for silver is also rising, particularly from the solar panel industry. With power prices remaining volatile globally, the demand for solar panels has increased, boosting the need for silver. This trend is evident as solar equities have reached their highest point this year.

Conclusion

The current economic backdrop suggests that silver remains a vital asset for investors. Silver’s upward trajectory might continue with central banks potentially cutting rates and increasing their precious metal holdings, along with the robust demand from industrial sectors. Staying informed about these factors can help investors make better decisions in the precious metals market.

Monitor central bank policies and industrial demand trends to effectively navigate the dynamic silver market.