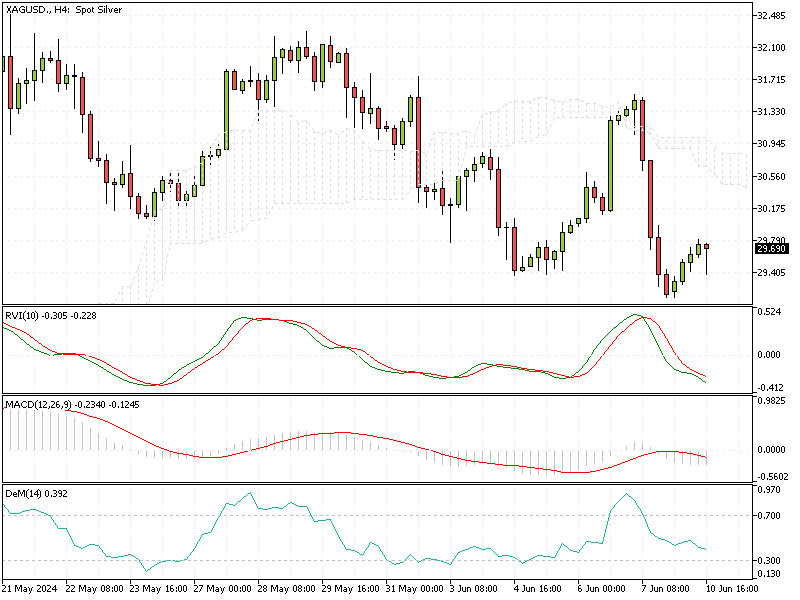

Silver Analysis – 10-June-2024

Silver prices have dropped below $30 per ounce, and a sharp decline from the 11-year high of $29.6 reached May 28th. This decrease is part of a broader fall in bullion prices, driven by strong economic data from the United States, which suggests the Federal Reserve may adopt a more aggressive stance on interest rates.

Silver Analysis – 10-June-2024

Silver Analysis – 10-June-2024

In May, non-farm payrolls increased significantly more than anticipated, highlighting the labor market’s strength. This development has pressured US Treasury yields and reduced the appeal of non-yielding assets like silver.

Additionally, the People’s Bank of China (PBoC) has paused its gold buying spree, which had been a significant factor in the strong performance of precious metals earlier this year. This pause has also contributed to the decline in silver prices.

Furthermore, the US has imposed a 50% tariff on Chinese imports of solar cells. Silver is a key component in solar panels, and this tariff aims to reduce production in factories located in Asia with ties to China. However, strong domestic demand in China, highlighted by the connection of the world’s largest solar farm in northwestern Xinjiang, has prevented silver prices from falling further.

Understanding these factors can help investors make informed decisions about their precious metal investments in the current economic climate.