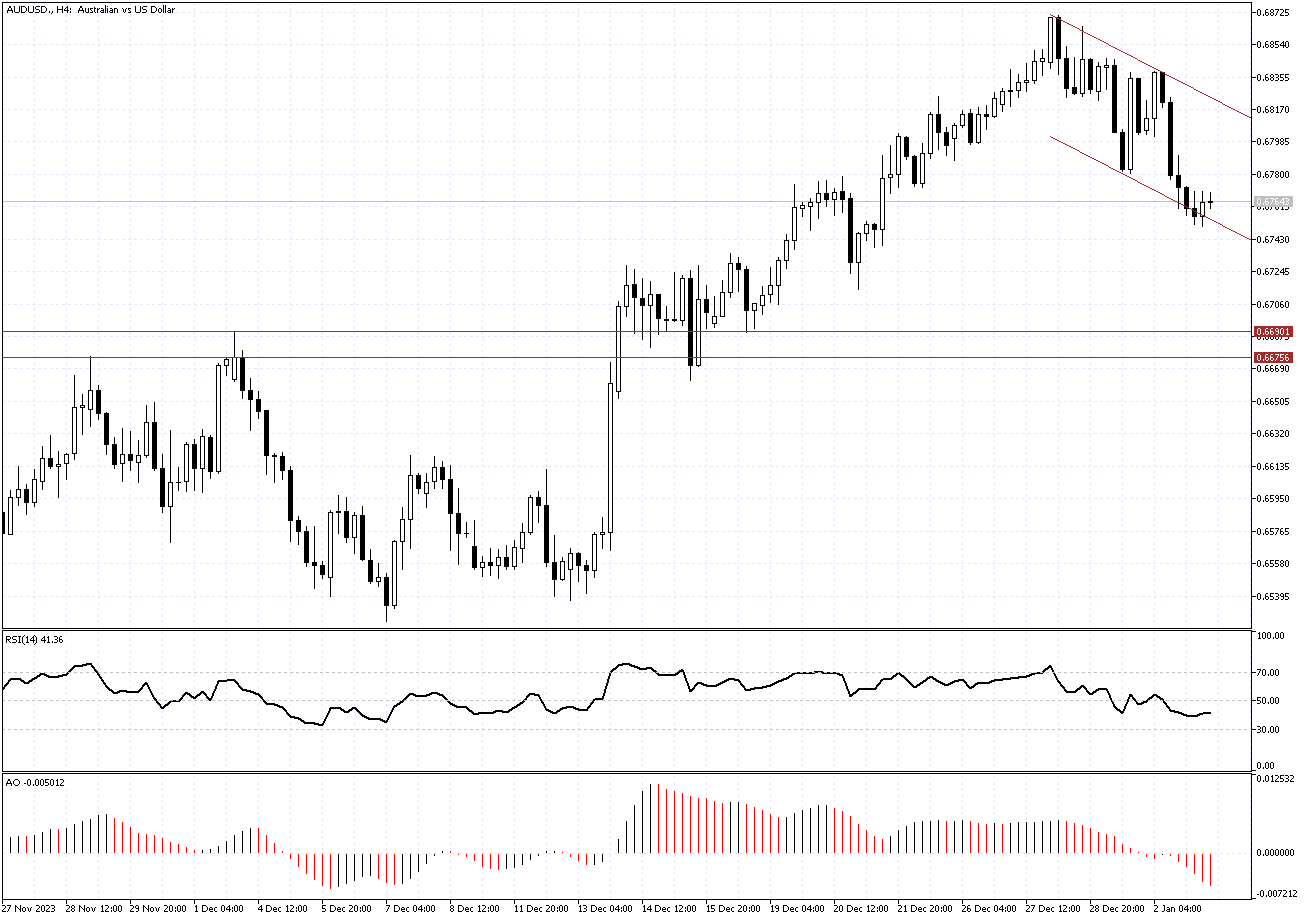

AUDUSD Analysis – January-03-2024

Recently, the Australian dollar has struggled, staying below $0.678. This is its weakest position in almost two weeks. The cause? A strong comeback by the US dollar. This surge came as investors scaled down their expectations of major interest rate cuts by the Federal Reserve within this year.

Additionally, there’s been a shift towards caution in the market. This change in attitude has seen a decline in both stocks and commodities from their previous high points. Meanwhile, US Treasury yields have seen an upward trend.

Back in Australia, the focus is on the Reserve Bank of Australia’s (RBA) next steps in monetary policy. Unlike other central banks that have raised rates significantly, the RBA has been more moderate. Therefore, experts predict that any reductions in rates by the RBA will either be less steep or delayed compared to other countries.

Inflation in Australia has been more stubborn than in many other places. RBA Governor Michele Bullock highlighted that the current economic challenges are largely domestic and driven by consumer demand.

AUDUSD Analysis – January-03-2024