Market Eyes OPEC+ Meeting for Oil Output Cuts

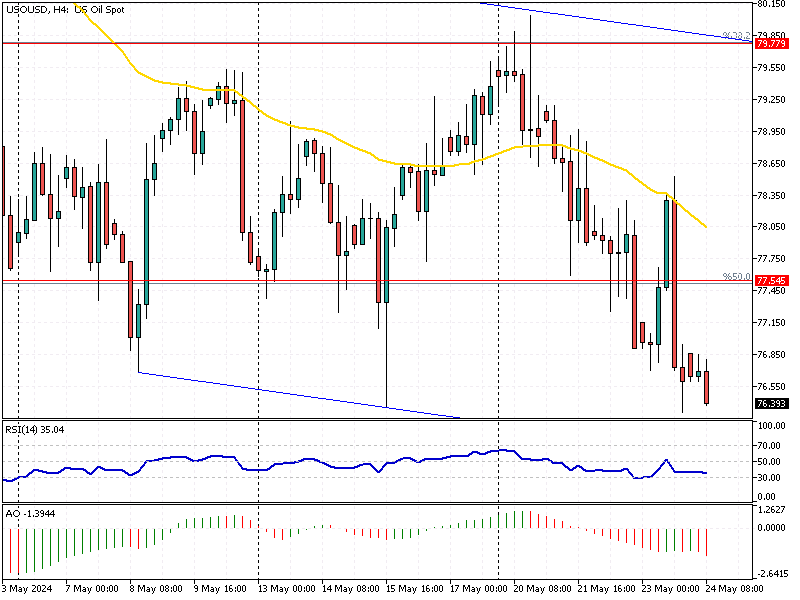

WTI Crude Oil Analysis—On Friday, WTI crude futures stabilized near $76 per barrel. However, they will still drop more than 3% this week. This decline comes as stronger-than-expected US PMI data reduced bets on Federal Reserve interest rate cuts this year, affecting the outlook for the US economy and energy demand.

Fed Rate Decisions and Inflation Concerns

The latest minutes from the Federal Open Market Committee (FOMC) revealed that some Fed officials are open to raising rates further if inflation surges. This stance adds uncertainty to the market as traders weigh the potential for more rate hikes against the likelihood of cuts.

Rising Crude Inventories and Gasoline Demand

The Energy Information Administration (EIA) reported an unexpected increase in US crude inventories last week. Stocks at the key storage hub in Cushing, Oklahoma, reached their highest level since July. Meanwhile, US gasoline demand hit its most robust levels since November, providing some stability to oil prices as the US summer driving season approaches.

Market Eyes OPEC+ Meeting for Oil Output Cuts

Looking ahead, the upcoming OPEC+ meeting on June 1 is drawing attention. Key oil producers are expected to extend output cuts to prevent a global oversupply and support prices. This meeting will be crucial for determining the direction of the oil market in the coming months.