Gold Prices React to Upcoming US Inflation Reports

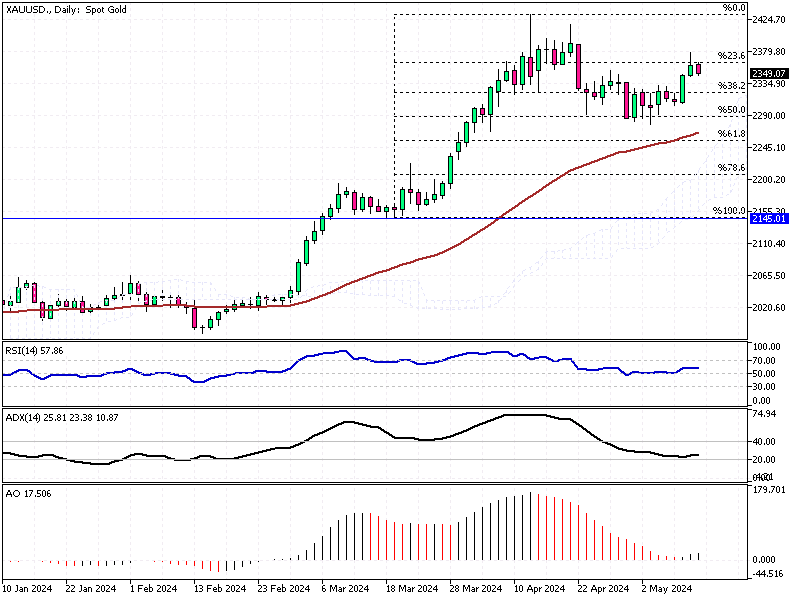

Gold prices experienced a notable drop, settling below $2,355 per ounce on Monday. This shift in the market is largely attributed to investors’ heightened attention to upcoming US inflation reports.

Gold Prices React to Upcoming US Inflation Reports

These reports are crucial as they provide insights into potential future actions by the Federal Reserve, particularly in light of recent ambiguous signals from Fed officials. With the Producer Price Index (PPI) scheduled for release on Tuesday and the Consumer Price Index (CPI) on Wednesday, the financial community keenly awaits these figures to gauge the likely monetary trajectory.

Market Sentiments and Economic Indicators

The anticipation of these reports follows a period of weaker-than-expected economic indicators, including a modest US payroll report for April and a disappointing jobs report last week. These developments have fueled speculation among investors and traders that the Federal Reserve might consider reducing interest rates as soon as September.

This speculation is critical for forex traders and investors to watch, as interest rate adjustments have significant implications for currency value and gold prices.

External Factors Influencing Gold

In addition to economic data, geopolitical tensions also play a significant role in the dynamics of gold prices. Recently, the escalation of conflicts in the Middle East, particularly the deployment of Israeli tanks into eastern Jabalia in the Gaza Strip, has reinforced gold’s status as a safe-haven asset.

This comes at a time when investments in the over-the-counter gold market have been robust, sustained by consistent purchases by central banks and growing demand from Asia.

Conclusion

These developments suggest a cautious approach to the market for investors and traders. Monitoring the upcoming inflation data and geopolitical events will be crucial in determining the short-term movements in gold prices and making informed investment decisions.