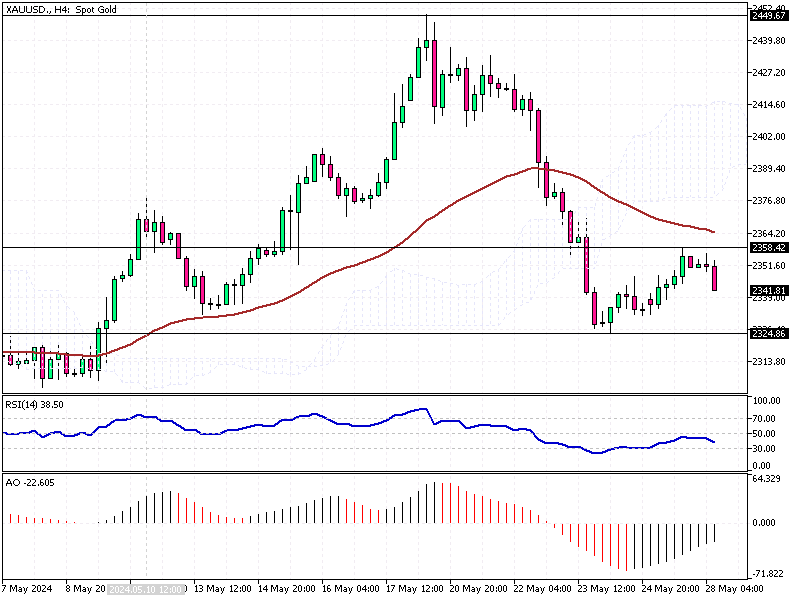

Gold Analysis – May-28-2024

Gold Analysis—On Tuesday, XAU/USD prices held around $2,350 per ounce. Investors remained cautious ahead of a critical US PCE inflation report, looking for clues on the Federal Reserve’s policy direction.

Gold Analysis – May-28-2024

The PCE inflation report, the Fed’s preferred measure of inflation, is expected to align with the CPI. This suggests that inflation did not accelerate, providing some relief to investors. Personal income and spending data are also scheduled for release and are projected to show a slowdown.

Geopolitical Tensions Boost Safe-Haven Appeal

Rising geopolitical risks in the Middle East supported gold’s safe-haven appeal. Reports of an Israeli airstrike that killed 45 people in a Rafah tent camp have prompted global leaders to urge the enforcement of a World Court order to halt Israel’s assault.

Impact of US Economic Data

We will closely watch the upcoming US economic data, including personal income and spending. These indicators will provide further insights into the Fed’s economic health and potential future actions.

Decline in China Gold Imports

Meanwhile, China’s net gold imports through Hong Kong dropped by 38% in April compared to the previous month. According to official data, this decline reflects changes in demand and trading patterns. (Source Bloomberg)

Summary

Gold remains a key focus for investors as we await crucial US economic data and monitor geopolitical developments. Stay informed to make better trading decisions.