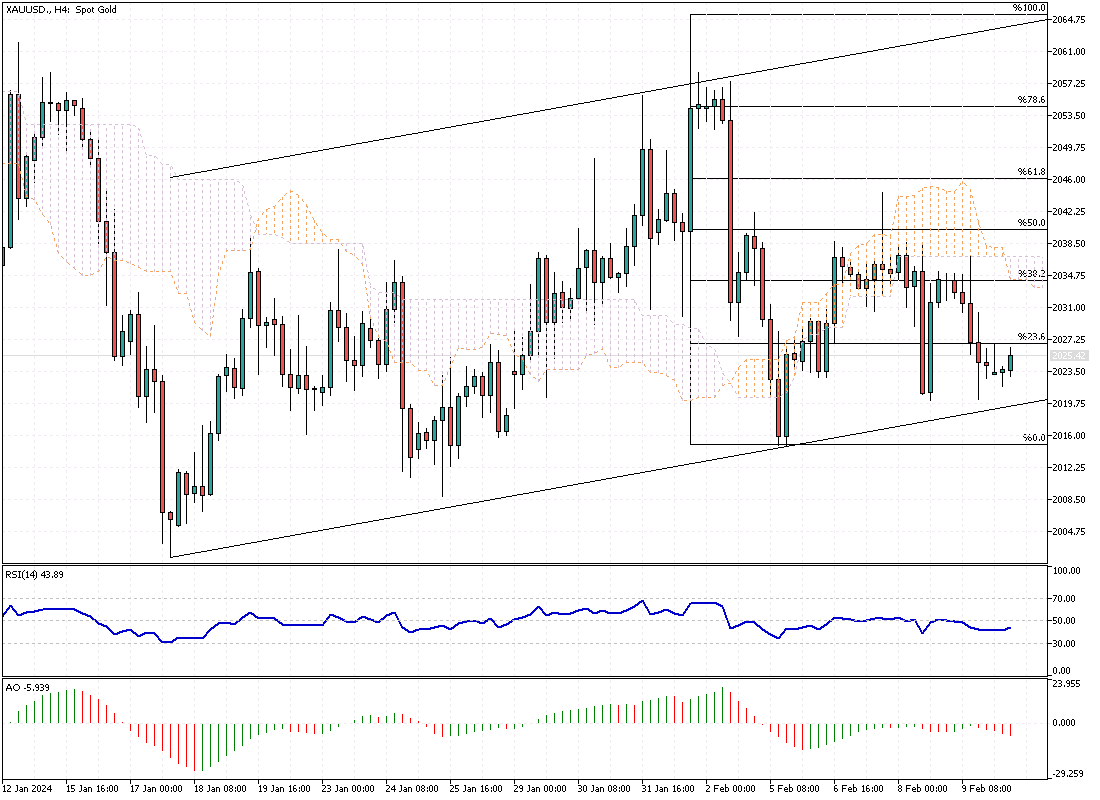

Gold Analysis – February-12-2024

XAUUSD – Gold’s price hovered around $2,020 per ounce at the start of the week, with its momentum tempered by the closure of key markets across the Asia Pacific for public holidays. Nations such as China, Hong Kong, Japan, South Korea, and Singapore took a break, leading to quieter trading conditions.

This period of inactivity comes at a time when investors are on edge, awaiting pivotal U.S. inflation updates that could significantly sway the Federal Reserve’s decisions on interest rates. The anticipation of this data has injected a note of caution into the market, affecting gold’s typical responsiveness to economic indicators.

Gold’s Muted Movement Amid Global Holidays

Despite expectations, gold didn’t see an uptick even when the U.S. corrected its December Consumer Price Index (CPI) figures, showing a less significant rise than initially thought. The Bureau of Labor Statistics (BLS) adjusted the CPI increase to 0.2% from the previously reported 0.3%, a minor but notable difference. Nonetheless, the core CPI, which excludes volatile food and energy prices, stuck to its 0.3% growth.

This nuanced adjustment in inflation data hints at the complex relationship between gold prices and economic indicators, where even slight changes can guide investor sentiment and future monetary policy expectations.

Economic Indicators and Federal Reserve Actions

As traders navigate through the week, they will focus not only on the upcoming U.S. retail sales and producer price inflation but also on the insights from several Federal Reserve officials. These economic indicators and official comments will be crucial in shaping market expectations for interest rate movements. Although there’s a slim possibility of a rate cut in March, the markets are leaning towards anticipating action by May.

This forward-looking perspective underscores the importance of understanding how central bank policies, alongside economic data releases, can influence investment strategies in gold and other precious metals. By keeping an eye on these developments, investors can better position themselves in a market that remains ever-responsive to the nuances of economic policy shifts.