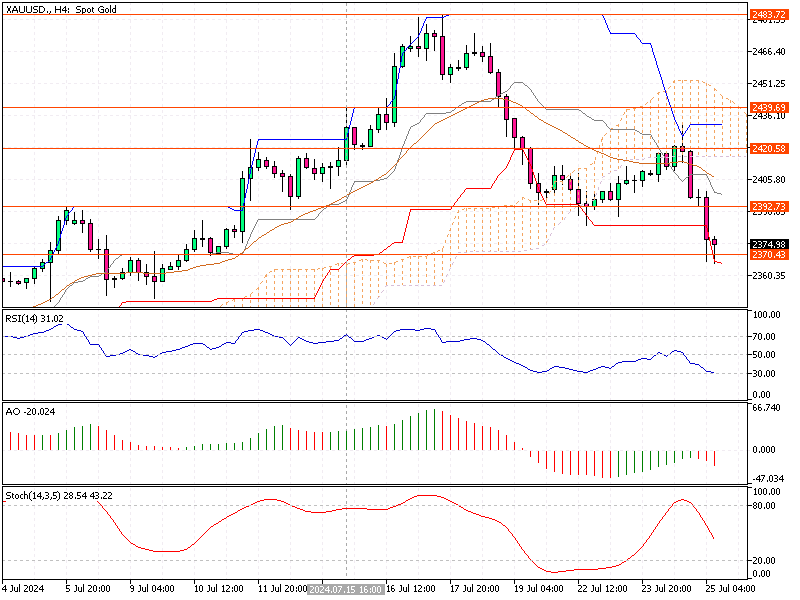

Gold Analysis 25-July-2024

Gold prices fell to about $2,370 per ounce on Thursday, reaching their lowest point in two weeks. This drop happened because investors were cautious before important US economic data was released.

This data could explain when the Federal Reserve might cut interest rates. Key pieces of information include the early numbers for the second quarter’s GDP, which will be released today, and the June PCE price index report, which will be released on Friday.

Gold Analysis 25-July-2024

The initial estimate for GDP growth in the second quarter is expected to show a 2% increase, up from the 1.4% growth in the first quarter. As for the PCE price index is predicted to rise by 0.1% after staying the same in May. The market is now expecting a rate cut from the Federal Reserve in September, with two more cuts likely before the year ends.

Additionally, there are predictions that India, the second-largest gold consumer in the world, will see a rise in physical gold demand. The Indian government has reduced the gold import tax from 15% to 6%.

For those who might not be familiar with the GDP (Gross Domestic Product), it measures all the goods and services produced in a country. An increase in GDP indicates a growing economy. The PCE (Personal Consumption Expenditures) price index measures the prices people in the US pay for goods and services, giving an idea of inflation levels. When inflation is low, it can lead to lower interest rates to encourage spending and investment.

Interest rate cuts by the Federal Reserve can make borrowing cheaper, stimulating economic growth. However, they can also affect the dollar’s value and commodity prices, such as gold. Investors often turn to gold as a safe investment, especially when there are uncertainties about economic policies and inflation.

Understanding these economic indicators and their potential impact can help investors decide about buying or selling gold.