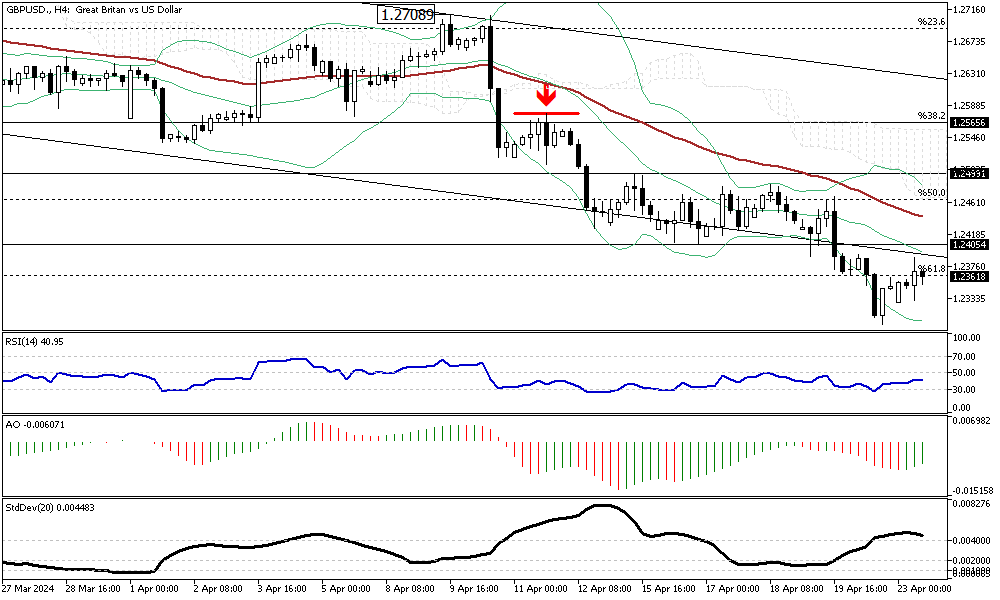

GBPUSD Analysis – Pound Hits New Low

GBPUSD Analysis – The British pound dipped to its lowest level since mid-November, sliding toward $1.236. A shift influenced this downturn in investor expectations regarding the Bank of England’s (BoE) monetary policy. Deputy Governor Dave Ramsden’s recent remarks played a crucial role, suggesting a softer approach may be imminent.

Ramsden indicated that the risk of persistently high inflation in the UK might be waning, which could lead to inflation falling below the BoE’s projections.

Mixed Signals from BoE Officials

The market’s response to Ramsden’s dovish stance was tempered by comments from another BoE official, Megan Greene. Greene highlighted concerns over recent economic indicators, such as robust wage growth and persistent inflation in the service sector. These factors suggest that the central bank should be cautious about lowering interest rates too soon.

Despite these warnings, market participants are now betting on an interest rate cut as early as August, a month earlier than previous forecasts suggested.

Dollar Maintains Strength

Amid these developments in the UK, the US dollar continued to exhibit strength. A series of hawkish statements from Federal Reserve officials support the dollar’s resilience. These remarks have bolstered the dollar as investors anticipate continued firmness in US monetary policy compared to the UK. The contrasting approaches of the two central banks have put additional pressure on the pound while propping up the dollar.