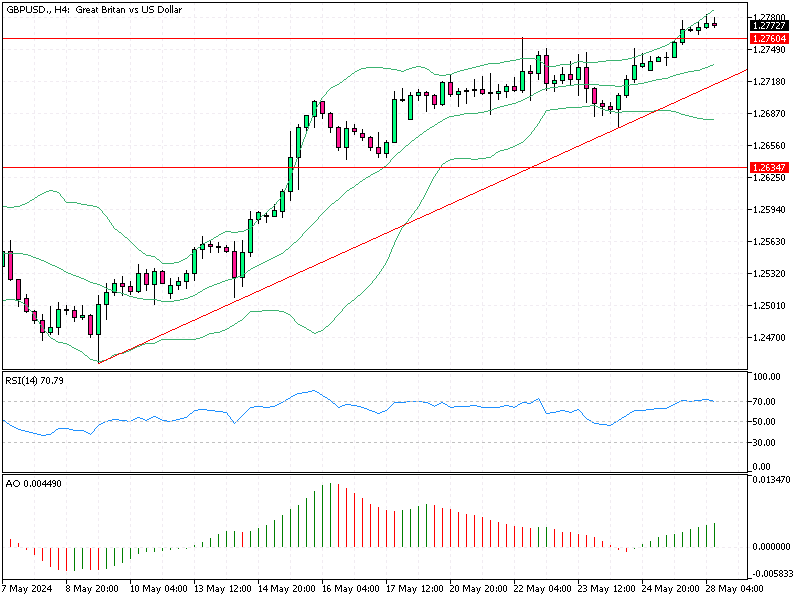

GBPUSD Analysis – May-28-2024

GBPUSD Analysis—The British pound recently reached around $1.275, its highest in two months. This surge comes as investors lower their expectations for the Bank of England (BoE) to cut interest rates. The political landscape is also shifting, with Prime Minister Rishi Sunak calling for general elections on July 4th.

GBPUSD Analysis – May-28-2024

Despite the UK’s annual inflation rate easing to 2.3%, closer to the BoE’s 2% target, it still surpassed forecasts of 2.1%. This has led investors to believe that the BoE will likely implement its first rate cut in September rather than the expected June. This shift in expectations is influencing market behavior significantly.

Another factor supporting the pound’s strength is the growing support for a government led by the opposition Labour Party. Many see the Labour Party as more business-friendly, which could create a favorable economic environment. Investors closely watch these political developments and their potential impact on the market. (Source Bloomberg)

Conclusion

The British pound’s recent rise reflects a complex interplay of economic data and political changes. Forex traders and investors should stay informed about these factors as they can significantly influence market dynamics. Understanding the timing of potential rate cuts and political shifts can help make better-informed decisions in the forex market.