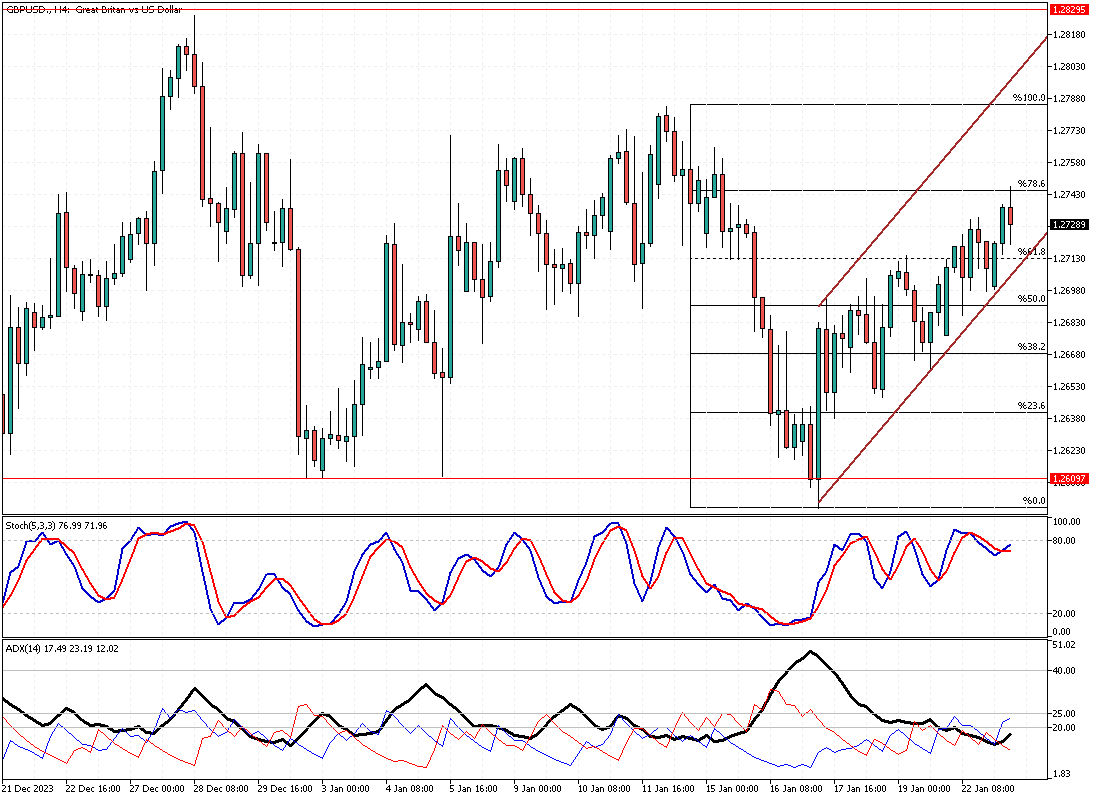

GBPUSD Analysis – January-23-2024

The British currency has found stability, currently trading at $1.27. This period of steadiness emerges as market participants keenly anticipate the release of the forthcoming flash PMI data. Additionally, there is a growing focus on the impending policy decision from the Bank of England, slated for the end of this month.

This heightened interest stems from concerns surrounding the slowdown of the UK economy, coupled with ongoing inflationary pressures. These economic challenges are central to investors’ expectations and speculations.

UK’s Economic Indicators: Retail Sales and Inflation

Recent economic indicators have painted a somewhat bleak picture of the UK’s financial health. In a significant development, retail sales in the UK witnessed a sharp contraction, declining by 3.2% in December. This decrease is notably the largest since January 2021 and exceeded initial predictions, anticipating a modest decline of 0.5%.

This substantial drop in retail sales has fueled speculations that the UK economy might have slipped into a recession during the last quarter of the previous year. Adding to these concerns, the latest Consumer Price Index (CPI) report has brought to light an unforeseen climb in the UK’s inflation rate, reaching 4%.

Labor Market Trends in the UK

The UK is experiencing notable shifts. The recent jobs report revealed a significant deceleration in wage growth. Furthermore, there’s a continuous downward trend in job vacancies, indicating potential challenges in the labor market. These labor market trends are crucial in understanding the UK’s overall economic landscape and are pivotal in shaping the Bank of England’s upcoming policy decisions.

The interplay of these economic factors – retail sales and inflation to employment trends – offers a comprehensive view of the UK economy’s current and potential future.