GBPUSD Analysis: Early Rate Cut Expected in UK

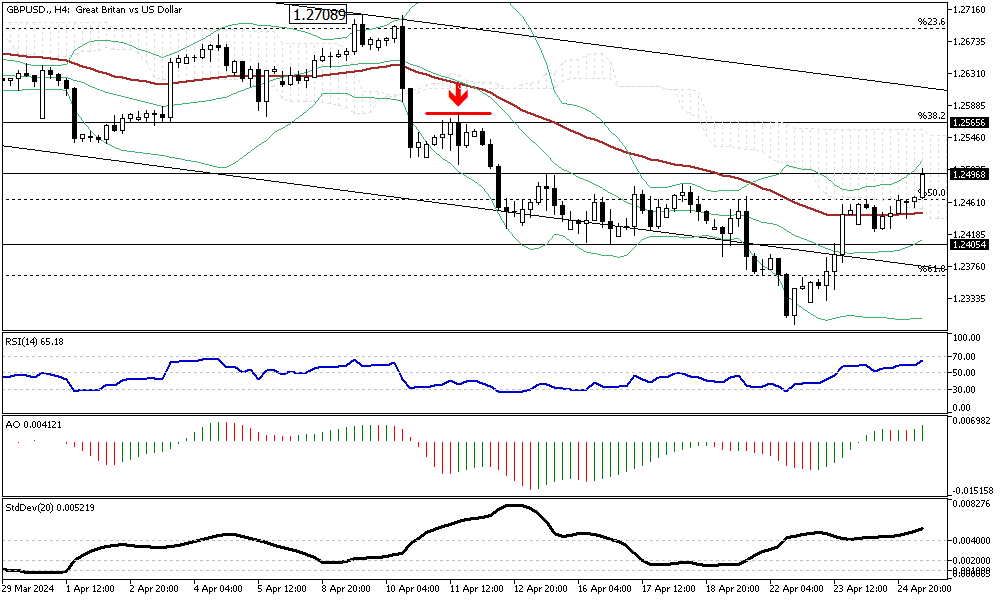

GBPUSD Analysis – The British pound is trading slightly above $1.24, staying near its lowest point since mid-November. This comes as investors respond to the latest UK PMI data, which could influence future decisions on monetary policy. The recent PMI report indicates a significant uptick in British business activity for April, marking the most robust expansion since May 2023.

This growth was primarily fueled by a surge in service sector output, signaling a potential shift in economic momentum.

Monetary Policy Adjustments on the Horizon

Expectations are now tilting towards an earlier adjustment in monetary policies than previously anticipated. Originally, markets forecasted a reduction in borrowing costs by September. However, recent comments from Bank of England’s Deputy Governor Dave Ramsden have shifted this expectation to August. Ramsden pointed out that the risk of persistently high inflation in Britain has decreased, possibly falling below the Bank’s earlier projections. This assessment suggests a more optimistic outlook on the economic front, influencing investor sentiments and monetary strategy.

Caution Amid Optimism

Despite the optimistic signs, caution remains in the air. Chief Economist Huw Pill acknowledged that the latest economic developments might hasten the timing of the first rate cut. Yet, he also cautioned that such a move could still be some distance away. This mixed messaging reflects the ongoing uncertainty surrounding the UK’s economic recovery path as officials balance optimism with realistic assessments of future challenges.