EURUSD Fundamental Analysis – 27-June-2024

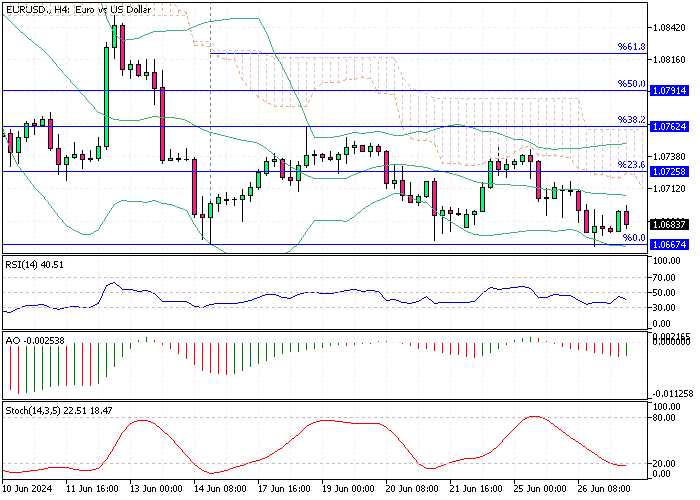

EUR/USD—The Euro has recently weakened to $1.0683, approaching a two-month low. This decline follows comments from ECB Governing Council member Olli Rehn, who hinted at the possibility of two more interest rate cuts this year. Additionally, consumer and business confidence in Germany and France has dropped, contributing to the Euro’s dip.

EURUSD Fundamental Analysis – 27-June-2024

European Inflation Trends to Watch Friday

Economic indicators are also in focus, with preliminary inflation data for major European economies, including France, Spain, and Italy, set to be released on Friday. Spain’s annual inflation rate is anticipated to fall to 3.3% in June from 3.6% in May. Meanwhile, Italy’s consumer prices are expected to rise by 0.2% month-on-month, consistent with May’s figures.

Uncertainty Looms Over French Elections

On the political front, investors are particularly anxious about the French legislative election. President Emmanuel Macron’s call for a snap election has introduced uncertainty. The election results could sway significantly between Marine Le Pen’s far-right party and a leftist alliance. A victory for either side could lead to significant policy changes, thereby impacting financial markets.

Final Words

Understanding these economic and political dynamics is crucial for making informed decisions. Anyone involved in or affected by the financial markets should keep an eye on upcoming data releases and election outcomes. This awareness can help navigate the Eurozone’s potential volatility and economic shifts.