GBPUSD Fundamental Analysis – 27-June-2024

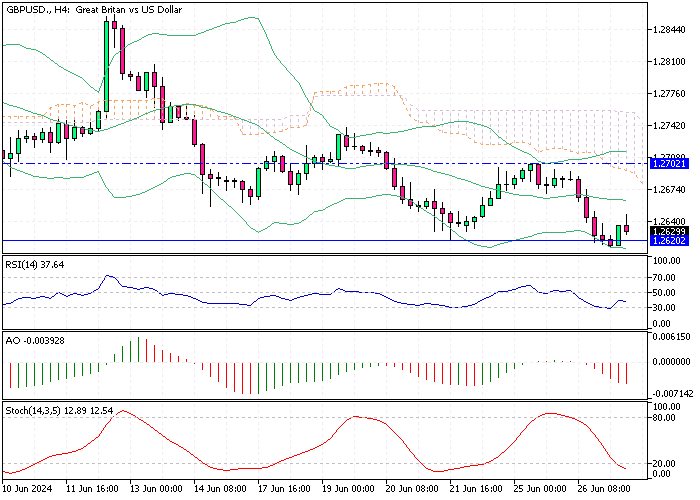

GBP/USD—The British pound has climbed to $1.262, rebounding from a six-week low. This recovery reflects investor reactions to recent developments in Britain’s monetary policy and political landscape.

GBPUSD Fundamental Analysis – 27-June-2024

BoE Holds Rates Steady Amid Rate Cut Talk

Last week, the Bank of England (BoE) decided to maintain interest rates at their current level, which has fueled speculation about a potential rate cut in August. Comments from BoE policymakers have added to these expectations. A recent domestic inflation report also showed that headline inflation has dropped to the BoE’s 2% target. This is a positive sign for the economy, indicating that inflation is under control.

However, upcoming GDP figures will be crucial for providing a clearer picture of the economic situation. Recent robust retail sales data have tempered some optimism sparked by the BoE’s comments, suggesting that the economy still faces challenges.

Gamble-gate Shakes Political Arena

The “Gamble-gate” scandal has caused significant turmoil. On the political front, the scandal involves aides of Prime Minister Rishi Sunak betting on the election date and casting a shadow over the current political campaign. This controversy could impact the country’s political stability, with predictions indicating a substantial lead for the Labour Party.

Final Words

Investors and the public await further economic and political developments, so the British pound’s performance remains a crucial indicator. Understanding these factors can help individuals make more informed financial decisions.