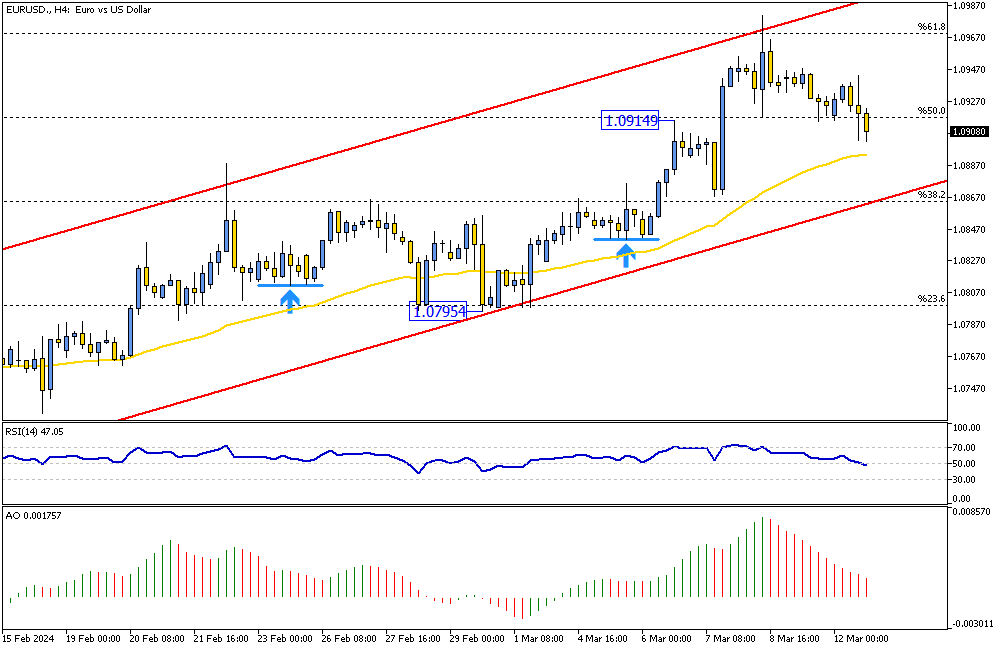

EURUSD Analysis – March-12-2024

EURUSD Analysis – The euro’s value is close to $1.09, which has yet to reach in nearly two months. This rise is due to the dollar’s weakening. Additionally, traders are busy figuring out future financial policies. Interest rate reductions by the Federal Reserve (Fed) and the European Central Bank (ECB) might happen soon. Many expect the first decrease to occur in June.

Interest Rate Cuts on the Horizon

The Fed and the ECB are hinting at potential interest rate cuts soon. This speculation has led investors to predict a decrease as early as June. The ECB, in particular, is expected to lower the cost of borrowing by about one percentage point throughout 2024. Several ECB officials are anticipating this move and are focusing on starting these rate cuts in June.

ECB’s Stance on Inflation and Borrowing Costs

In March, the ECB kept the borrowing rates at very high levels. They did this because they’ve successfully controlled inflation to some extent. However, they acknowledge that significant price increases and wage growth are still happening. The ECB also updated its inflation predictions.

They expect inflation to be 2.3% this year, decreasing to 1.9% by 2025. This shows they are making some headway in managing economic pressures.