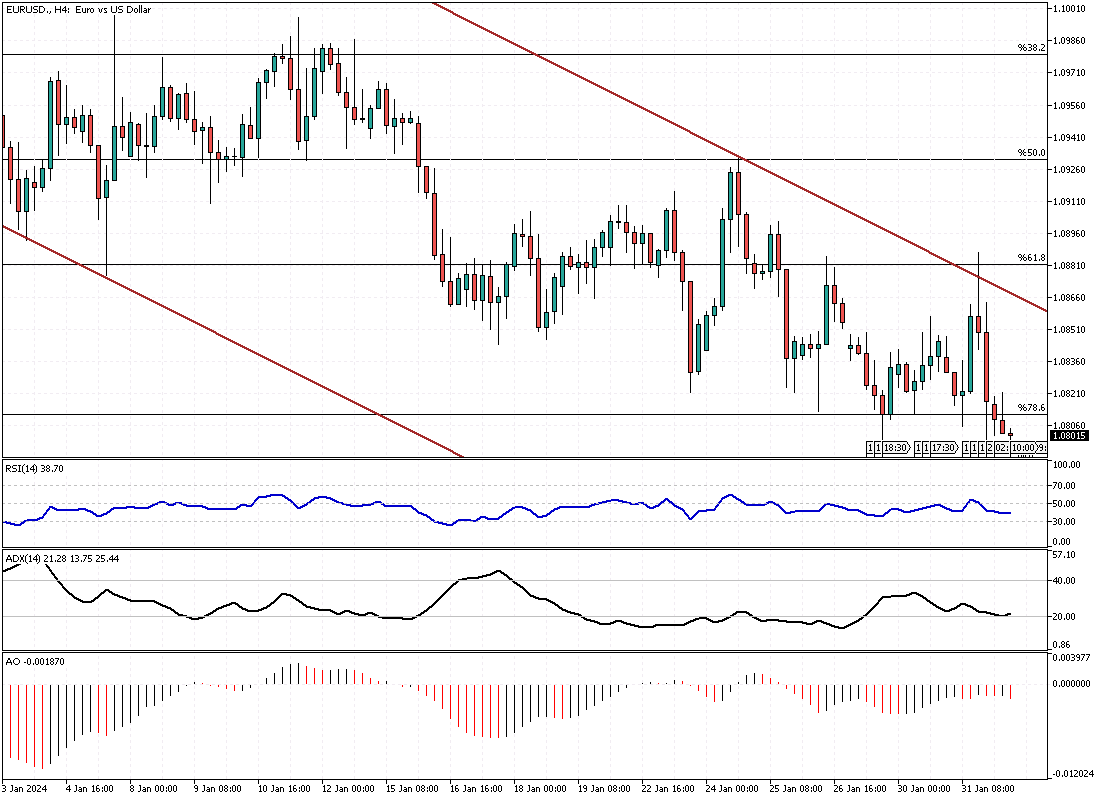

EURUSD Analysis – February-1-2024

As January draws close, the EURUSD is shaky, trading around $1.08—marking its lowest point since December 12th. This decline comes as investors meticulously analyze inflation and GDP figures emerging from some of Europe’s key economies. Germany and France reported a slowdown in inflation for January, presenting a glimmer of hope for stabilizing prices. Conversely, Spain’s inflation rate took an unexpected turn upward.

Amid these mixed signals, the overall economic performance of the Eurozone painted a somewhat brighter picture, narrowly dodging a technical recession in the last quarter of 2023. This resilience was underpinned by Spain and Italy, whose robust growth compensated for Germany’s contraction and France’s standstill.

Central Bank’s Influence on the Euro

The euro’s 2% depreciation over the month can be attributed to market anticipation of a policy shift by the European Central Bank (ECB). Recent comments from ECB officials hint at a dovish turn in monetary policy, with expectations solidifying around a rate cut in April. Such speculations gained momentum following remarks from policymaker Nagel, who confidently declared the central bank’s success in curbing the “greedy beast” of inflation—a notable change from his typically reserved commentary.

De Guindos, Centeno, and Kazimir echoed this sentiment, alluding to a forthcoming rate reduction as the ECB’s next strategic move. This collective stance from the ECB’s leadership signals a potentially significant pivot in the bank’s approach to managing the Eurozone’s economic landscape.

Implications for Investors and the Eurozone Economy

The evolving narrative around the euro and the ECB’s monetary policy stance holds profound implications for investors and the broader Eurozone economy. A rate cut could stimulate economic activity by making borrowing cheaper, yet it also risks reigniting inflationary pressures.

For investors, the current uncertainty around the euro offers both challenges and opportunities. Navigating this volatile landscape requires understanding the interplay between monetary policy, economic indicators, and market sentiment. As the ECB possibly prepares to adjust its course, the coming months will be critical in shaping the Eurozone’s economic trajectory, with the potential to influence global financial markets.