Euro Steady at $1.08 – What It Means for Traders

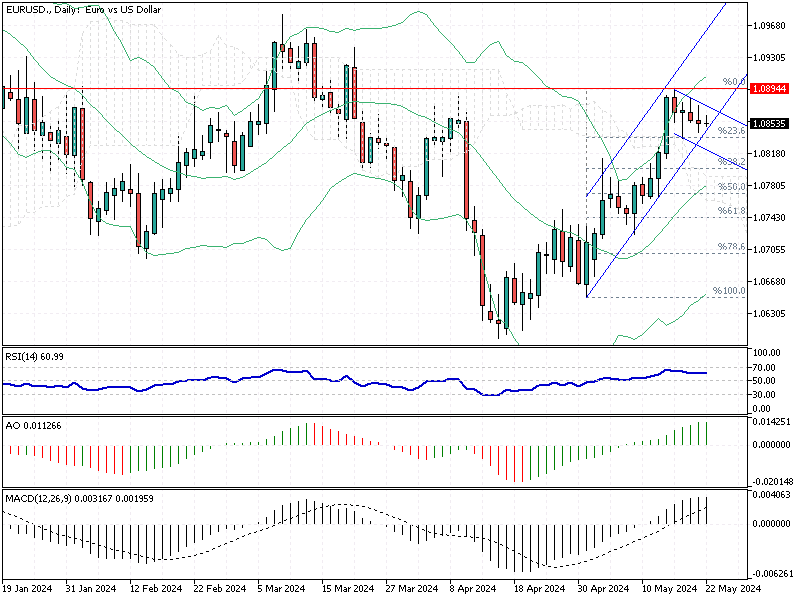

The Euro has been hovering around $1.08 (EUR/USD) as we approach the end of May. This level is close to the highs seen in March. The Euro benefits from a weaker dollar, driven by growing expectations that the Federal Reserve will cut interest rates this year. For forex traders, this trend highlights the importance of staying attuned to shifts in monetary policy on both sides of the Atlantic.

Euro Steady at $1.08 – What It Means for Traders

In Europe, the ECB might lower borrowing costs as early as June. However, there is some uncertainty about the future, as many policymakers are urging caution. The current inflation rate in the Euro Area stands at 2.4%, which is very close to the ECB’s target of 2%.

This is a significant drop from the 7% inflation rate a year ago. Traders should monitor ECB announcements, as any policy changes can impact the Euro’s value.

Economic Recovery in the Euro Area

Recent GDP estimates show that the Euro Area’s economy emerged from a recession in the first quarter of this year. The European Commission’s new forecasts suggest a “soft landing” scenario, meaning the economy is expected to grow without significant setbacks. This positive outlook can support the Euro and may influence trading strategies.

Key Takeaways for Forex Traders

- Dollar Weakness: The Euro is benefiting from a general weakness in the US dollar, mainly due to expectations of rate cuts by the Fed.

- ECB Policy: Potential rate cuts by the ECB in June could impact the Euro’s strength, but long-term actions remain uncertain.

- Inflation and GDP: The significant drop in inflation and positive GDP growth are encouraging signs for the Euro Area economy.

Staying informed about these factors can help forex traders make better decisions in this dynamic market.