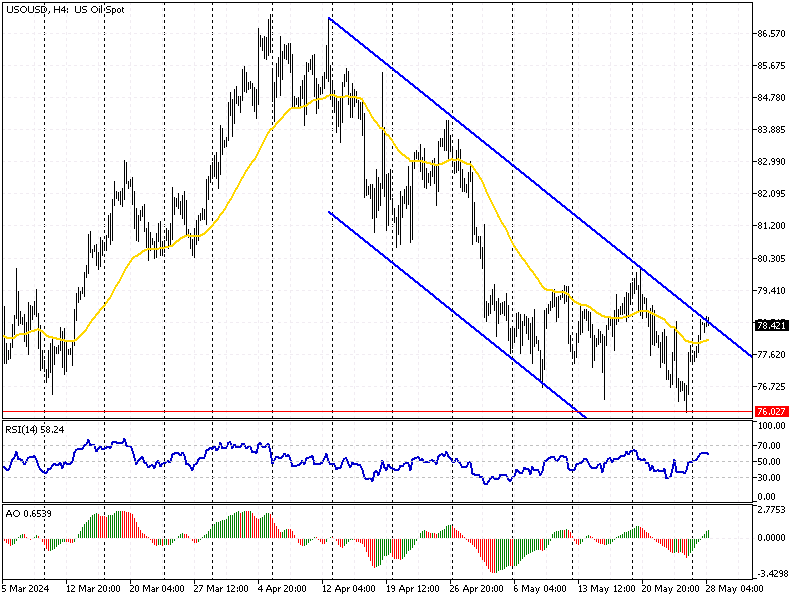

Crude Oil Analysis – May-28-2024

Crude Oil Analysis—Tuesday’s WTI crude futures rose toward $79 per barrel. This increase follows expectations that OPEC+ will extend voluntary output cuts of 2.2 million barrels per day into the year’s second half. This decision will be confirmed at its meeting on June 2.

Crude Oil Analysis – May-28-2024

On the demand side, markets are closely watching a key US inflation report this week. The outcome will help traders assess the Federal Reserve’s monetary policy path. If the US PCE price index shows softer-than-expected inflation, it could lead to bets on earlier interest rate cuts, supporting economic growth and energy demand.

European Inflation and ECB Decisions

Traders also look ahead to inflation readings from Germany and the Euro Zone. These reports will be crucial in shaping expectations that the European Central Bank (ECB) might start cutting rates next week. Lower interest rates in Europe could significantly influence forex markets.

Forex traders can make better decisions and anticipate market movements by staying informed about these critical economic indicators. Watch OPEC+ decisions and inflation data from the US and Europe to stay ahead in the forex market. (Source Bloomberg)