AUDUSD Analysis – December-22-2023

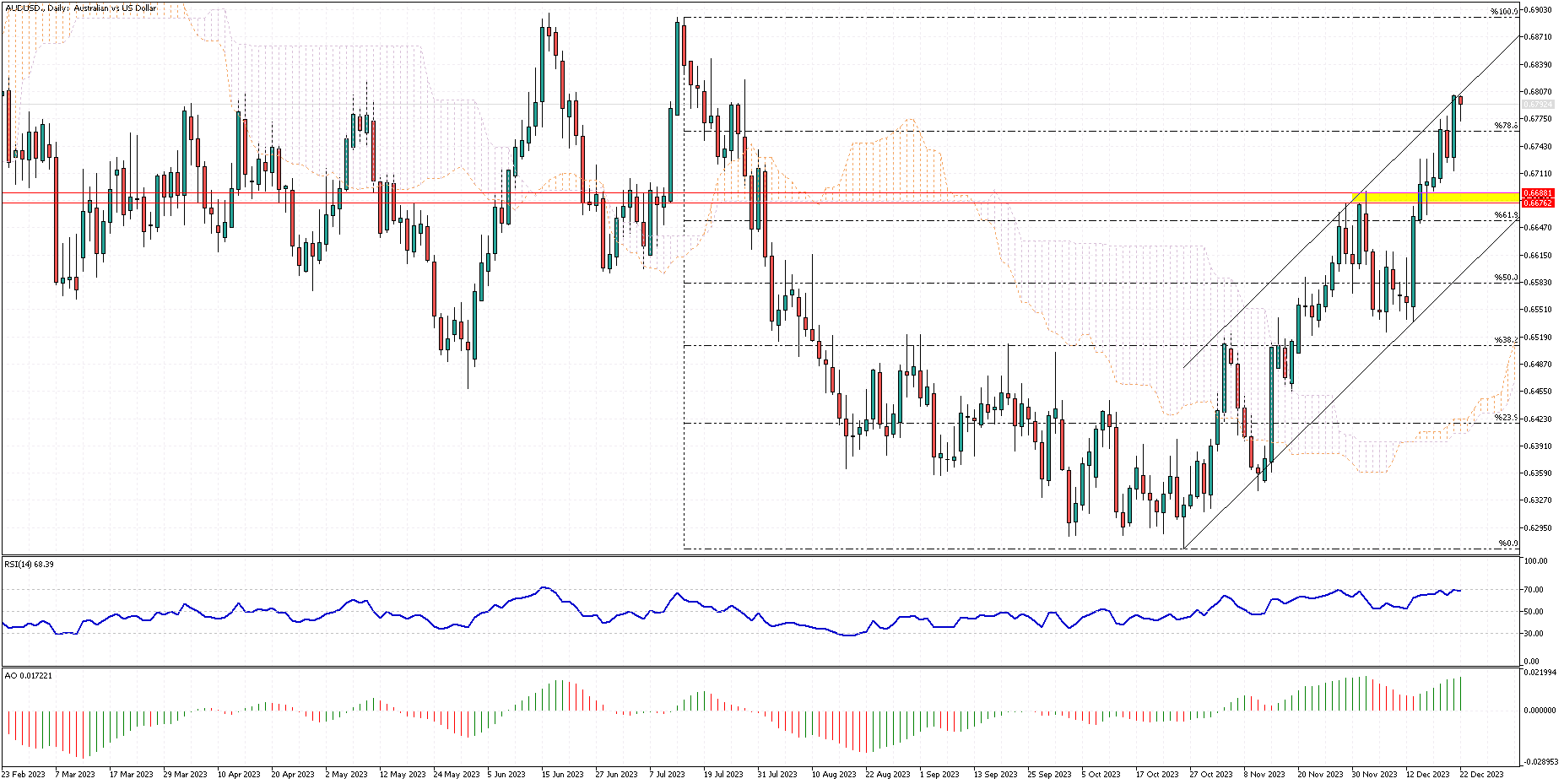

The currency pair’s upward momentum shows no signs of easing. Currently, the pair is moving along the upper line of the bullish flag. In today’s session, the AUDUSD price neared the 78.6% Fibonacci support level with the RSI around 70. This implies potential bearish activity despite the bullish trend.

For retail traders with a smaller balance, entering long positions at the current market price may not be advisable. It might be prudent to wait for the pair to retract slightly. Should the market fall below the 78.6% level, it could reach the support area between 0.6681 and 0.6676. This zone offers an attractive entry point for bullish traders.

Given the pair’s strong upward momentum, the target appears to be the highest from June 2023.

AUDUSD Technical Analysis: Conclusion

In conclusion, buying the Australian dollar is not recommended at this time, regardless of the current trend’s strength. The market appears overbought, and the AUDUSD will likely lose some of its gains eventually. A more strategic approach would be to wait for this pullback before considering joining the uptrend.