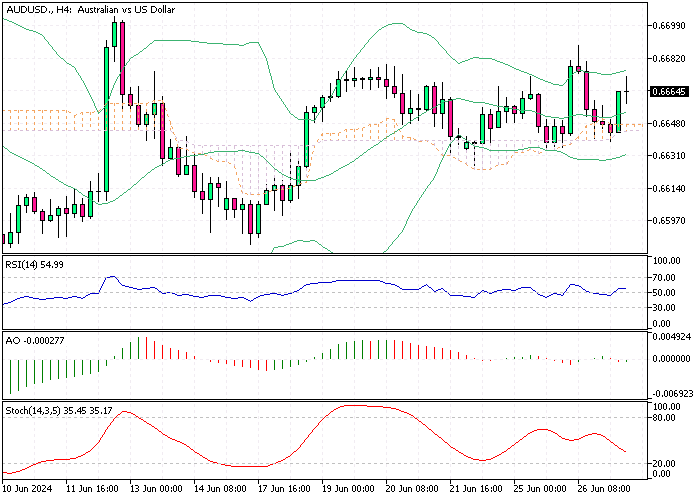

AUDUSD Fundamental Analysis – 27-June-2024

AUD/USD—The Australian dollar has stabilized around $0.665, gaining support due to rising inflation concerns. Recent data revealed that Australia’s Monthly Consumer Price Index (CPI) jumped by 4% in May, up from 3.6% in April and surpassing market expectations of 3.8%. This increase marks the highest inflation rate since November last year.

The surge in inflation has led to fears that the Reserve Bank of Australia (RBA) might raise interest rates in their next meeting in August.

AUDUSD Fundamental Analysis – 27-June-2024

RBA Rate Hike Probability at 42% for August

Market analysts estimate a 42% probability that the RBA will hike rates in August, dismissing any potential for a rate cut this year. Investors eagerly await the release of Australia’s second-quarter CPI figures at the end of July, which will provide further insights into the economic outlook and guide future RBA decisions.

US Dollar Rises on Fed’s Hawkish Stance

Despite the steadiness of the Australian dollar, the US dollar gained some ground due to hawkish comments from a Federal Reserve official. Fed Governor Michelle Bowman stated that inflation in the US will likely remain high for an extended period, indicating that it is not yet time to consider cutting interest rates.

Final Words

This economic environment underscores the importance of investors’ and policymakers’ closely monitoring inflation trends and central bank signals. Understanding these dynamics is crucial for making informed decisions in the current economic landscape.