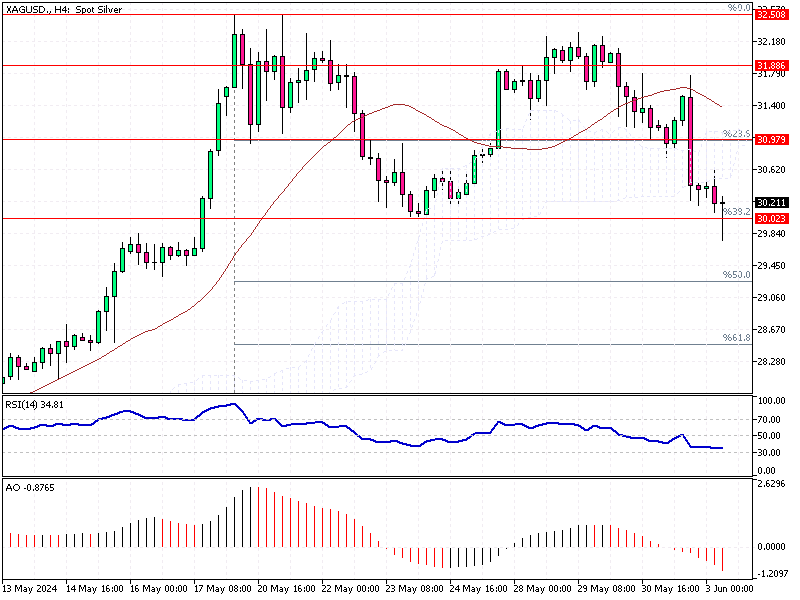

Silver Analysis – 3-June-2024

Silver prices are steady at $31.7 per ounce after hitting their highest point since December 2012. This stability comes as investors digest comments from Federal Reserve officials about future monetary policy.

Fed Vice Chair Michael Barr highlighted the need for more time to assess the impact of restrictive policies. Similarly, Atlanta Fed President Raphael Bostic predicted only one rate cut this year.

Silver Analysis – 3-June-2024

Low Stockpiles Drive Silver Market

High interest rates often reduce the appeal of non-yielding assets like silver. Despite this, silver prices are supported by its critical role in industrial applications. The market is facing its fourth consecutive year of supply shortages.

This trend is evident in the London Bullion Market Association’s stockpiles, which fell to the second-lowest level on record in April. Additionally, the silver volumes on exchanges in New York and Shanghai are near seasonal lows.

Conclusion

These factors suggest a nuanced landscape for investors. While high interest rates could limit gains, the ongoing supply deficits and industrial demand provide strong support for silver prices. Monitoring Federal Reserve policies and stockpile levels will be crucial for making informed decisions in this market.