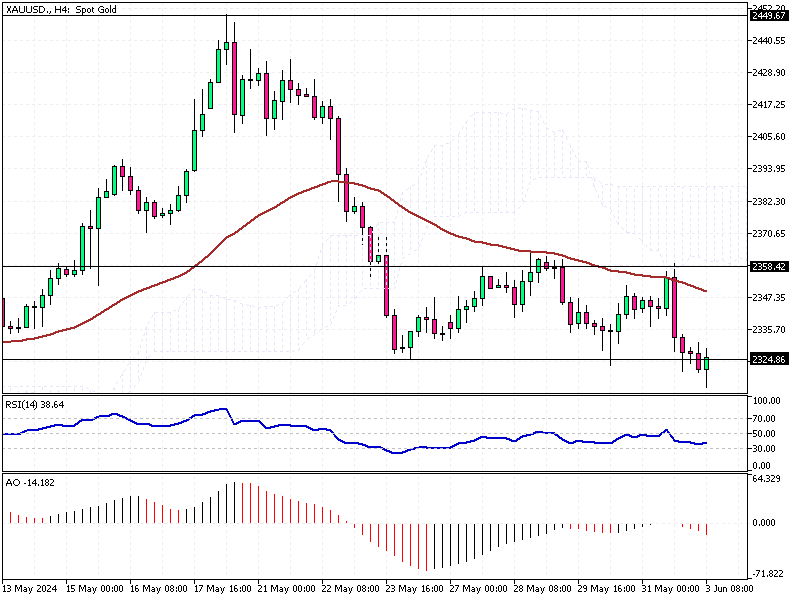

Gold Analysis – 3-June-2024

Gold prices held steady at around $2,330 per ounce on Monday. Investors are digesting recent US inflation data and awaiting more economic information to gauge when the Federal Reserve might ease monetary policy.

Last Friday, data showed core PCE prices slowed down in April compared to March. Meanwhile, the monthly and yearly rates stayed exact, meeting predictions. This suggests that the Fed might have room to lower rates this year.

Gold Analysis – 3-June-2024

Traders Eye Key US Labor Market Data

Traders eagerly await the US nonfarm payrolls data and other labor market indicators due this week. These figures are critical as they influence expectations on the Fed’s rate cut plans, which have been adjusted to anticipate only one cut this year.

The European Central Bank (ECB) anticipates cutting rates in Europe this week. However, increased inflation in May has raised doubts about further rate cuts after June. Similarly, the Bank of Canada is expected to lower rates within the week.

Conclusion

Investors should monitor these developments, as they can significantly impact financial markets and economic decisions. Staying informed will help them make better investment choices amid the evolving economic landscape.