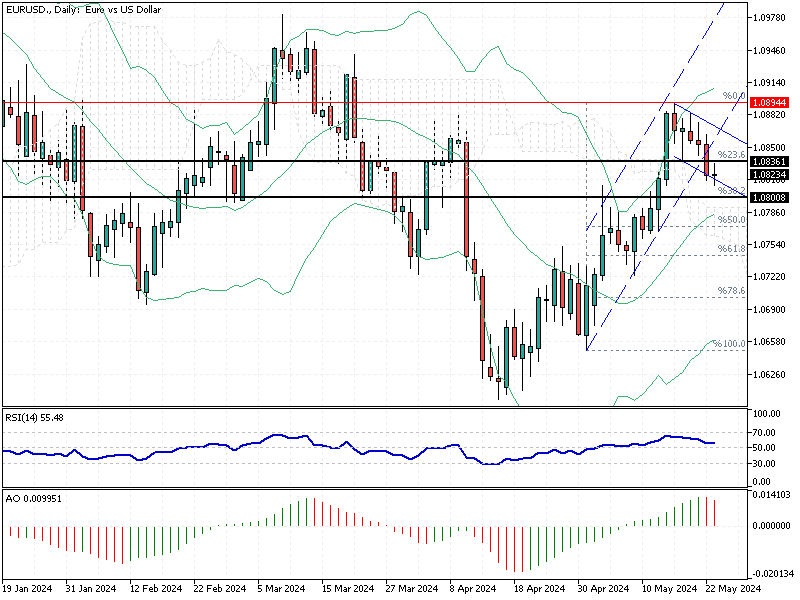

EURUSD Nears $1.08 Amid Central Bank Moves

As we approach the end of May, the Euro is hovering around $1.08 (EUR/USD). It reached a high earlier this month, but it has edged lower since then. Traders closely watch the outlook of monetary policy to make informed decisions.

EURUSD Nears $1.08 Amid Central Bank Moves

The recent minutes from the Federal Open Market Committee (FOMC) meeting and comments from several Federal Reserve officials indicate a hawkish stance. They suggest that interest rates in the US will stay elevated for a while because progress toward reducing inflation isn’t strong enough. This hawkish approach is influencing the strength of the dollar.

ECB’s Potential Rate Cuts

Bloomberg—In contrast, the European Central Bank (ECB) will likely lower borrowing costs soon, possibly in June. President Lagarde mentioned a substantial likelihood of a move on June 6th if the data supports the confidence that inflation will drop to 2% in the medium term. Currently, the inflation rate in the Euro Area is at 2.4%, close to the ECB’s target of 2% and significantly lower than the 7% rate from a year ago.

Economic Growth in the Euro Area

Recent GDP estimates for the Euro Area show that the economy has emerged from recession in the first quarter. New forecasts from the European Commission also suggest a soft landing scenario, indicating a stable economic recovery.

Making Informed Trading Decisions

For forex traders and investors, staying updated on these economic indicators and central bank policies is crucial. The divergence in strategies between the Fed and the ECB could create trading opportunities. Analyzing the latest data and forecasts will help you make informed decisions.

Understanding these economic signals enables you to navigate the forex market more effectively. Stay tuned for more updates and insights to guide your trading strategies.