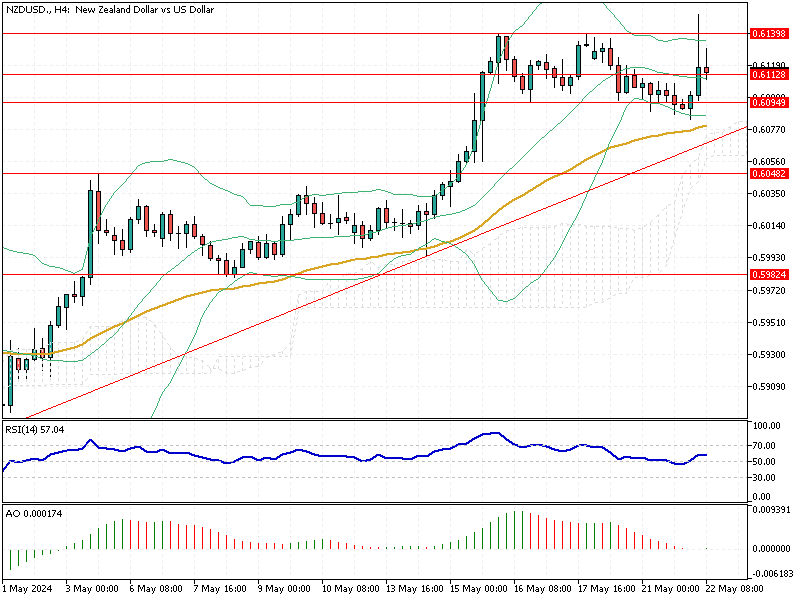

NZDUSD Rises Amid Rate Decision and Hawkish Outlook

The New Zealand dollar recently climbed above $0.6111 (NZD/USD) after the Reserve Bank of New Zealand (RBNZ) decided to keep the official cash rate unchanged at 5.5% during its May meeting. This move was widely expected, but the central bank’s hawkish outlook surprised the market.

NZDUSD Rises Amid Rate Decision and Hawkish Outlook

The RBNZ has now extended the rate pause for the seventh consecutive time. The bank emphasized that the policy needs to stay restrictive for a longer period to ensure inflation falls back to its target. Despite the annual inflation rate slowing to 4% in the first quarter, it still remains outside the central bank’s target range.

The central bank projects that inflation will return to its 1-3% target range by the end of this year. This is a critical goal for the RBNZ, which aims to stabilize the economy and maintain purchasing power.

Future Rate Expectations

Additionally, the RBNZ raised its forecast for the peak rate to 5.7% from 5.6%. The bank also delayed its expected timeline for cutting rates, now projecting the first cut to happen in the third quarter of 2025, rather than the second quarter.

Forex markets are now looking forward to the release of the Federal Open Market Committee (FOMC) minutes later today. These insights will provide further clarity on the Federal Reserve’s policy stance, which can significantly impact global currency movements.

Making Informed Decisions

For forex traders and investors, understanding these updates is crucial. The RBNZ’s decisions and projections provide valuable insights into future market conditions, helping traders make informed decisions.