GBPUSD Strengthens Amid UK Inflation Figures

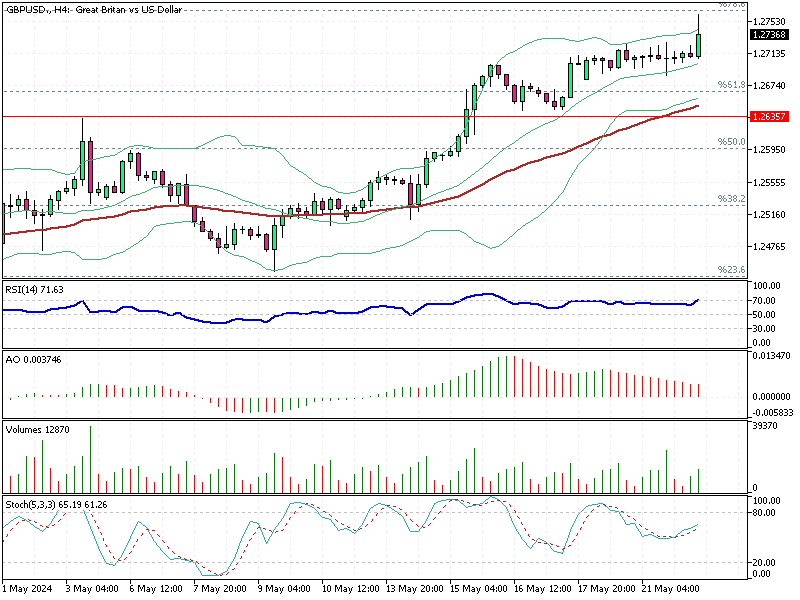

The British pound recently reached $1.275 (GBP/USD), its most substantial level in nearly two months. This surge follows higher-than-expected inflation figures in the UK, influencing the forex market and trader expectations.

GBPUSD Strengthens Amid UK Inflation Figures

In April, the UK’s annual inflation rate eased to 2.3%, closer to the Bank of England’s target of 2%. Despite this decrease, it was still higher than the forecasted 2.1%. Additionally, core inflation, which excludes volatile items like food and energy, slowed for the third month to 3.9%, the lowest since October 2021 but still above the expected 3.6%.

Market Reactions

The surprising inflation figures have caused investors to nearly eliminate the chance of a rate cut by the Bank of England in June. The market anticipates the first reduction in borrowing costs, which might not happen until November.

In May, the Bank of England kept interest rates steady, with two members favoring a decrease and indicating a potential shift towards lower borrowing costs in the future.

What This Means for Traders

Forex traders should take note of the current economic landscape in the UK. The unexpected inflation data suggests that the Bank of England might delay cutting interest rates, which could keep the pound strong in the near term. Traders should watch for further economic updates and Bank of England announcements, as these will clarify future market movements.