NZDUSD Analysis – RBNZ Holds Firm on Rates

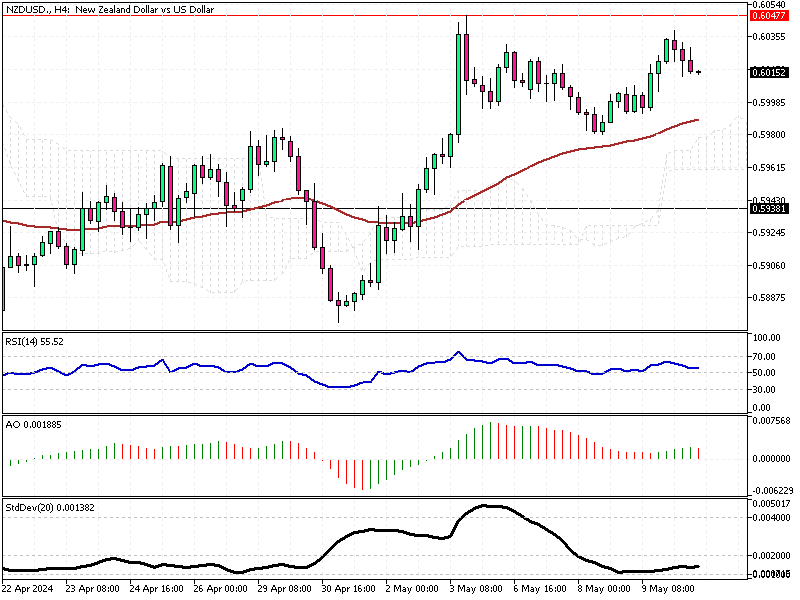

The New Zealand dollar, commonly known as the Kiwi, experienced a notable increase, reaching a one-month peak trading around $0.601 (NZDUSD). This surge was largely due to a dip in the US dollar after an unexpected rise in US weekly jobless claims to an eight-month high.

This economic indicator led forex traders to speculate that the Federal Reserve might cut interest rates later this year.

NZDUSD Analysis – RBNZ Holds Firm on Rates

Investors and traders are now keenly awaiting more US economic data and statements from Federal Reserve officials, which could provide further insights into the future direction of US interest rates.

These developments are watched closely as they have significant implications for the strength of the US dollar and, consequently, the trading dynamics of the Kiwi.

Reserve Bank of New Zealand’s Firm Stance

Domestically, the Reserve Bank of New Zealand (RBNZ) is expected to hold its interest rate at 5.5% in the upcoming meeting. This decision aligns with the OECD’s recommendation to keep monetary policy tight until there are definitive signs that inflation is converging towards the target.

Additionally, New Zealand’s manufacturing sector showed early signs of recovery in April despite the prolonged recession affecting the country’s economy.