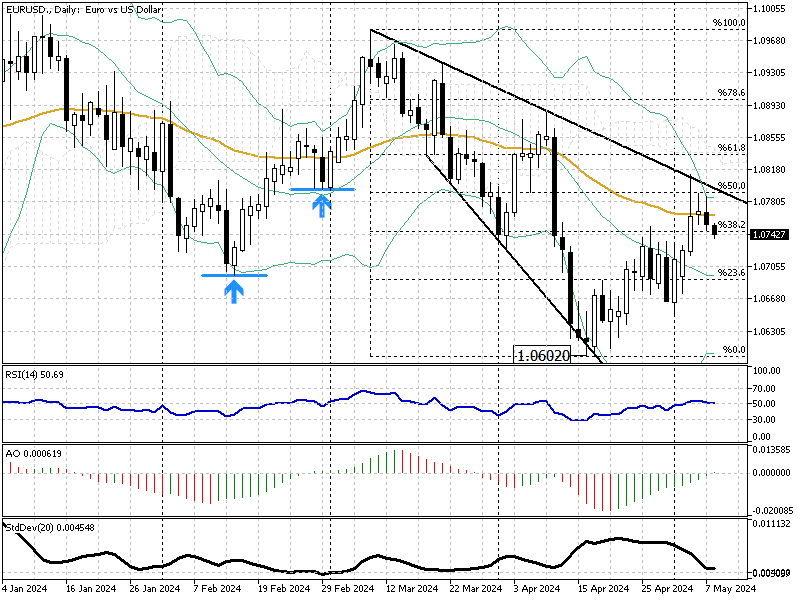

EURUSD Analysis – Fed and ECB Diverging Paths?

As of early May, the Euro has approached $1.07 (EURUSD), hitting near one-month highs. This recent surge stems from traders evaluating the changing landscape of monetary policies. Key to this evaluation is the anticipation surrounding the Federal Reserve’s (Fed) potential policy adjustments and the European Central Bank’s (ECB) upcoming decisions.

Fed and ECB Diverging Paths?

There’s growing optimism that the Fed might ease its policies later this year, particularly after the latest U.S. labor data is weaker than expected. This softer data suggests less upward inflation pressure, potentially reducing the need for tight monetary control.

In contrast, the ECB is poised to cut borrowing costs starting in June. Chief ECB economist Philip Lane expressed increased confidence that inflation will stabilize at the ECB’s target of 2%. While most ECB officials support a move towards easing in June, ECB President Christine Lagarde has yet to indicate a commitment to further rate cuts.

Economic Indicators and Investor Insights

Despite the proactive stance from central banks, inflation in the Euro Area has remained steady at 2.4% as of April, with economic growth ticking up by 0.3% in the first quarter. These figures underscore a cautiously optimistic outlook for the Eurozone economy, which may influence Euro trading in the coming months.

Investors should watch for any divergence between the Fed’s and ECB’s policies, as these could introduce volatility and trading opportunities in the forex market.