AUDUSD Analysis: Strong CPI Data Bolsters Aussie

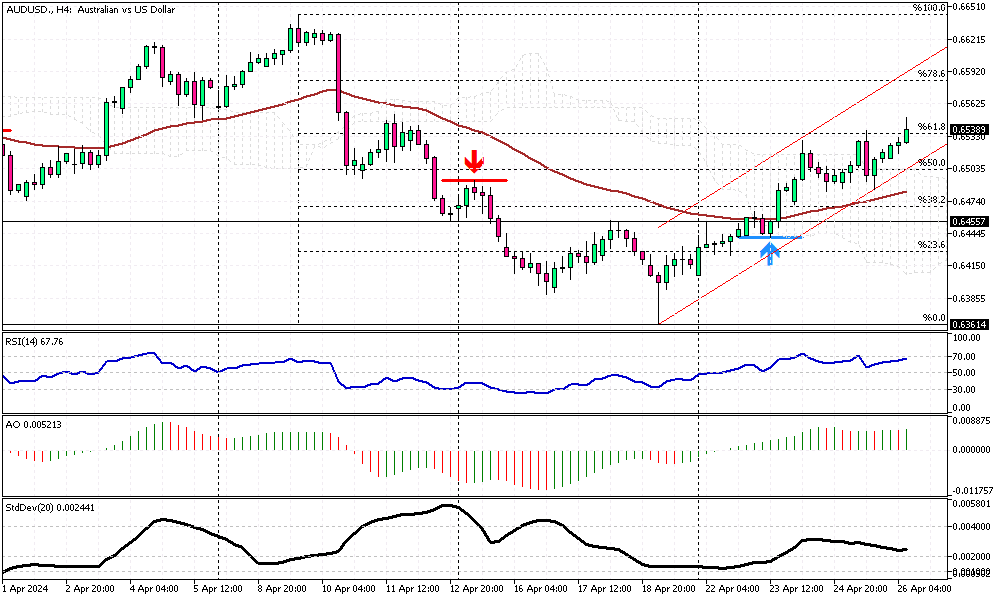

The Australian dollar surged to $0.655, marking its highest point in almost two weeks. This rise was fueled by robust domestic inflation figures, which exceeded expectations. These strong numbers suggest that the Reserve Bank of Australia might keep interest rates stable for the foreseeable future.

In the first quarter, Australia’s consumer price index (CPI) dipped to 3.6% from 4.1% in the prior quarter. Although this is the fifth consecutive quarter of decline, the rate was still higher than the forecasted 3.4%.

Inflation Trends and Economic Indicators

Further insights into inflation showed that Australia’s monthly CPI accelerated to 3.5% in March, up from 3.4% in February. This was contrary to market predictions, which anticipated no change. This unexpected increase indicates sustained economic price pressures, which could influence future monetary policy decisions.

Other economic indicators show signs of vigor, with private sector growth witnessing the most significant uptick in two years during April. Manufacturing activity is nearing stability, and the services sector has expanded for three consecutive months.

External Factors Supporting the Aussie

Externally, the Australian dollar also gained traction due to a weakening US dollar. Economic activity in the US has cooled off in April, leading to a more cautious stance on monetary policy from the Federal Reserve. This shift in the US has indirectly supported the strength of the Aussie by making it more attractive to investors looking for viable alternatives in the currency markets.