AUDUSD Falls Amid Global Conflict

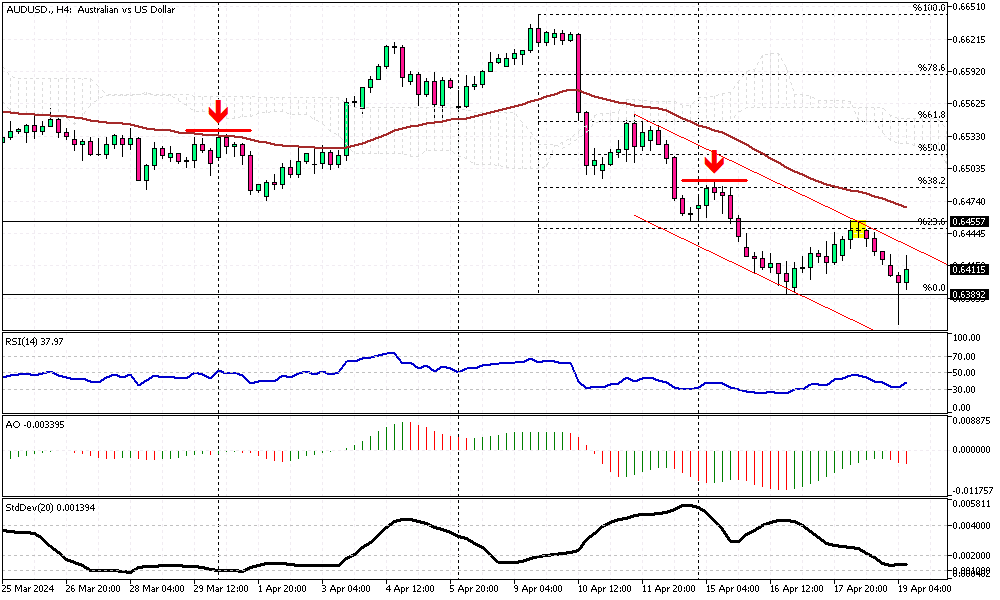

AUDUSD Analysis – The Australian dollar has recently fallen below $0.641, reaching its lowest value in five months. This sharp decline was triggered by a surge in risk-averse behavior in global financial markets. This shift in market sentiment comes in the wake of Israel’s military actions against targets in Iran, Iraq, and Syria. These strikes were in retaliation to Tehran’s assaults on Israel, sparking fears and driving investors to safer assets.

Domestic Factors Also Weigh

International events, domestic economic indicators, and policy expectations impact the Aussie. Comments from the U.S. Federal Reserve suggesting a more cautious approach to lowering interest rates this year have further pressured the Australian currency.

Back home, the Reserve Bank of Australia (RBA) appears poised to cut rates later this year. This is influenced by a slight uptick in the unemployment rate to 3.8% in March from 3.7% in February. This data has reinforced a more dovish stance on Australia’s monetary policy.

Economic Outlook and Monetary Policy

Although the RBA has indicated that further rate hikes are unlikely, it remains cautious about easing monetary policy too soon. A recent report from Westpac highlighted that the RBA requires greater certainty about the inflation landscape before considering rate reductions. This cautious approach reflects a complex balancing act for Australia’s central bank as it navigates domestic economic challenges and external geopolitical risks.