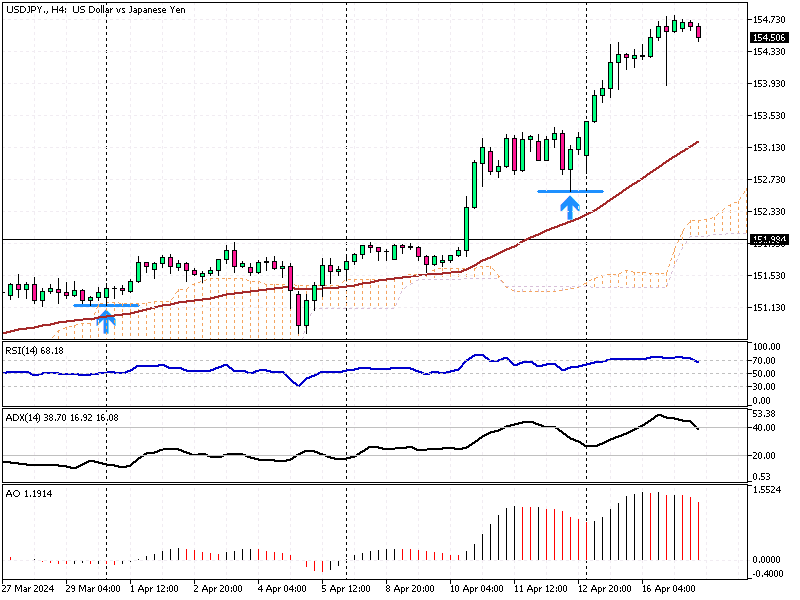

USDJPY Analysis – Yen Hits 34-Year Low

USDJPY Analysis – The Japanese yen has reached a significant low, trading at 154 to the dollar, marking its lowest point in 34 years. This decline comes amid a stark contrast in monetary policies between the United States and Japan.

The U.S. Federal Reserve has maintained its Fed funds rate at a 23-year high of 5.25% and 5.5%, indicating that rates will remain steady until at least September. This decision aligns with recent economic indicators from the United States, showing a healthy economic landscape. For instance, March saw U.S. retail sales increase by 0.7%, exceeding expectations of a 0.3% rise and building on a 0.9% growth in February. These figures complement other positive reports on employment and inflation, suggesting a robust U.S. economy.

Japan’s Soft Policy vs. U.S. Hikes

Meanwhile, Japan’s monetary policy paints a different picture. Despite the Bank of Japan ending eight years of negative interest rates and reducing its asset purchases, Japan’s key short-term interest rate hovers just above zero, at 0% to 0.1%. This soft approach contrasts sharply with the aggressive rate hikes by the U.S. Federal Reserve.

Furthermore, traders who had anticipated intervention from the Bank of Japan to bolster the yen are now adjusting their expectations, as such measures seem increasingly unlikely. This has contributed to the yen’s continued weakness against the dollar.

The divergence in monetary policies and economic outlooks between the two countries is clear, with the U.S. displaying strength and resilience. At the same time, Japan remains cautious, impacting the yen’s value on the global stage.