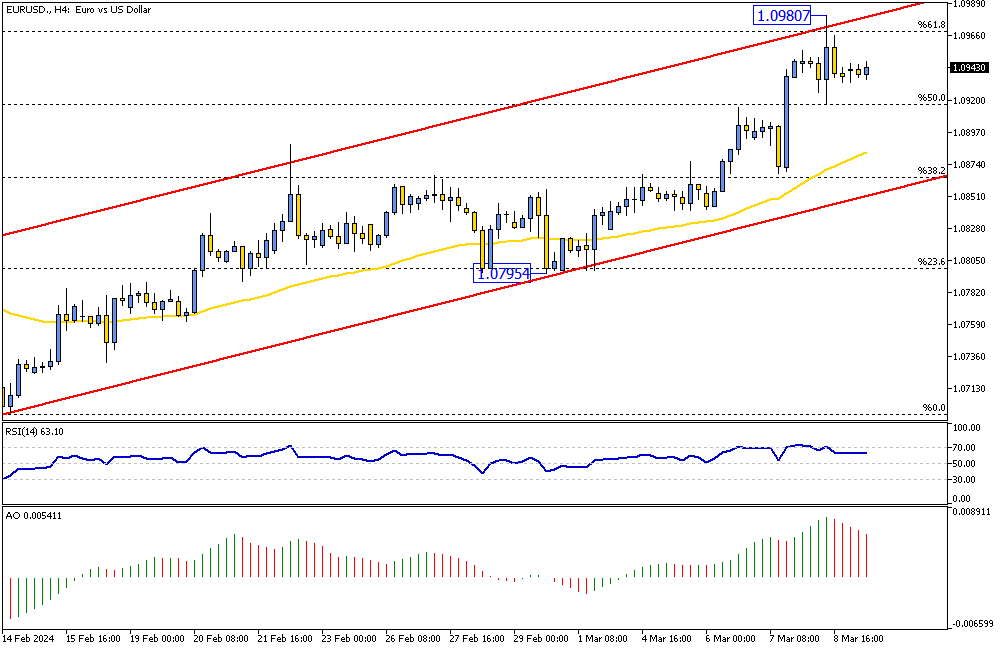

EURUSD Analysis – March-11-2024

EURUSD Analysis – The euro has recently increased in value, worth more than $1.09. This is its highest value since the middle of January. The main reasons are the weak US dollar and new job data from the US. Additionally, comments from Fed Chair Powell suggest the Federal Reserve might lower interest rates soon, possibly in the middle of this year. This information has made people more interested in the euro.

EURUSD Analysis: ECB Keeps Interest Rates High

In Europe, the European Central Bank (ECB) has decided to keep interest rates very high. They believe they are progressing in fighting high prices despite some concerns, like ongoing high prices and substantial pay increases for workers. However, they have lowered their expectations for future price increases. They think prices will increase by 2.3% this year but will slow down to 1.9% by 2025.

Future Financial Strategies in Europe

During a meeting, ECB President Lagarde spoke to reporters but did not mention any plans to lower interest rates right now. However, she suggested they might start talking about making it easier for banks to lend money. But, she said they need to see more proof before lowering interest rates. This shows they are careful and want to ensure they have all the information before making big decisions.