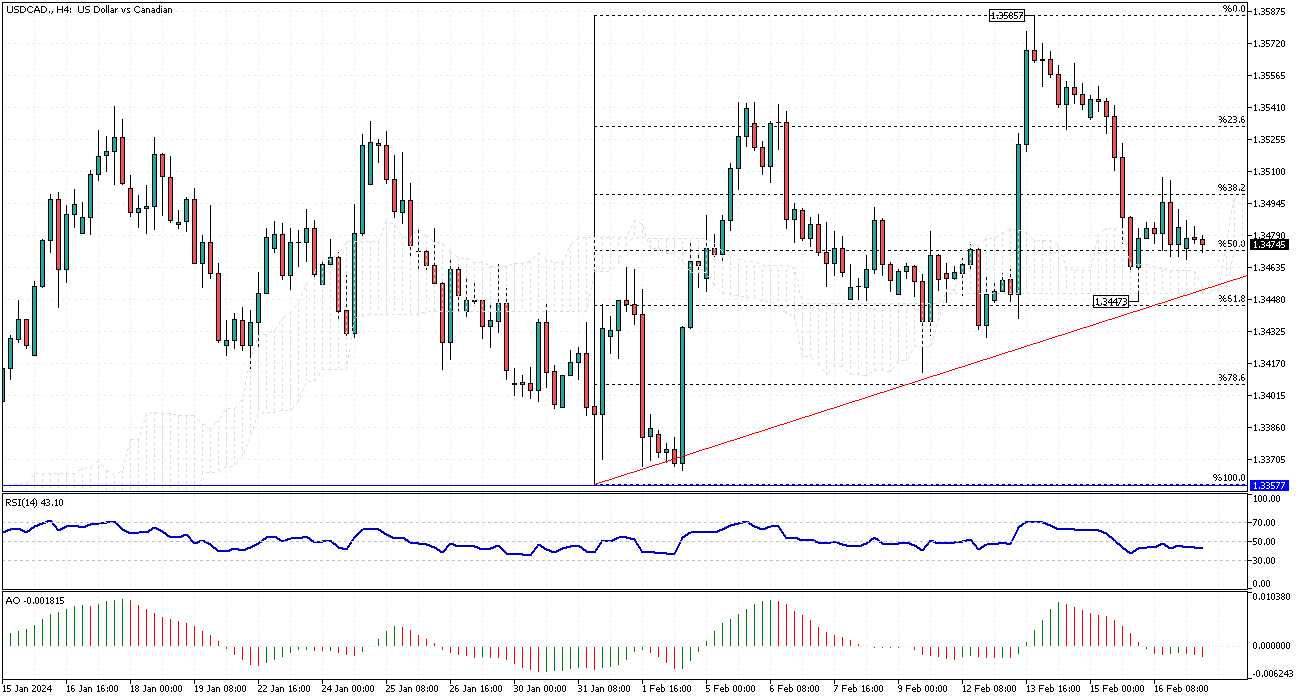

USDCAD Analysis – February-19-2024

The Canadian dollar experienced a decline, surpassing the 1.35 mark against the US dollar (USDCAD), edging closer to its nearly two-month low at 1.345 recorded on February 9th. This downturn was primarily due to persistent inflationary pressures in the United States, which tempered expectations for an imminent rate reduction by the Federal Reserve, thereby strengthening the US dollar.

This shift negated the Canadian currency’s recent advances, spurred by favorable domestic labor market reports. The Canadian job market showed robust health in January, adding approximately 40,000 jobs and reducing the count of unemployed individuals by around 20,000. This positive change led to a decrease in the unemployment rate for the first time since December 2022, injecting a dose of optimism into perceptions of the Canadian economic climate.

USDCAD Analysis: Labor Resilience & Economic Challenges

The Canadian labor market has shown signs of resilience despite prevailing economic challenges. The significant job additions and reduced unemployment underscore the economy’s strength and potential for growth. This improvement has offered a counter-narrative to the growing skepticism surrounding Canada’s economic prospects, mainly as Bank of Canada (BoC) policymakers highlight the stifling effects of high-interest rates on expansion efforts. The labor market’s performance is a beacon of hope, indicating that despite the high-interest rate environment designed to curb inflation, segments of the economy retain the momentum necessary for recovery and growth.

Economic Outlook and Monetary Policy Implications

The current economic landscape presents a complex interplay between inflationary pressures and growth prospects. The Bank of Canada’s stance on maintaining high-interest rates underscores a strategic approach to managing inflation, albeit with acknowledged impacts on economic growth. However, the resilient labor market may provide the BoC with nuanced insights as they navigate monetary policies.

The sustained job growth suggests underlying strengths that could mitigate the adverse effects of high interest rates, offering a silver lining amidst concerns about inflationary pressures. As policymakers and analysts watch these developments, the evolving dynamics will be crucial in shaping Canada’s economic strategies and monetary policy decisions in the coming months.