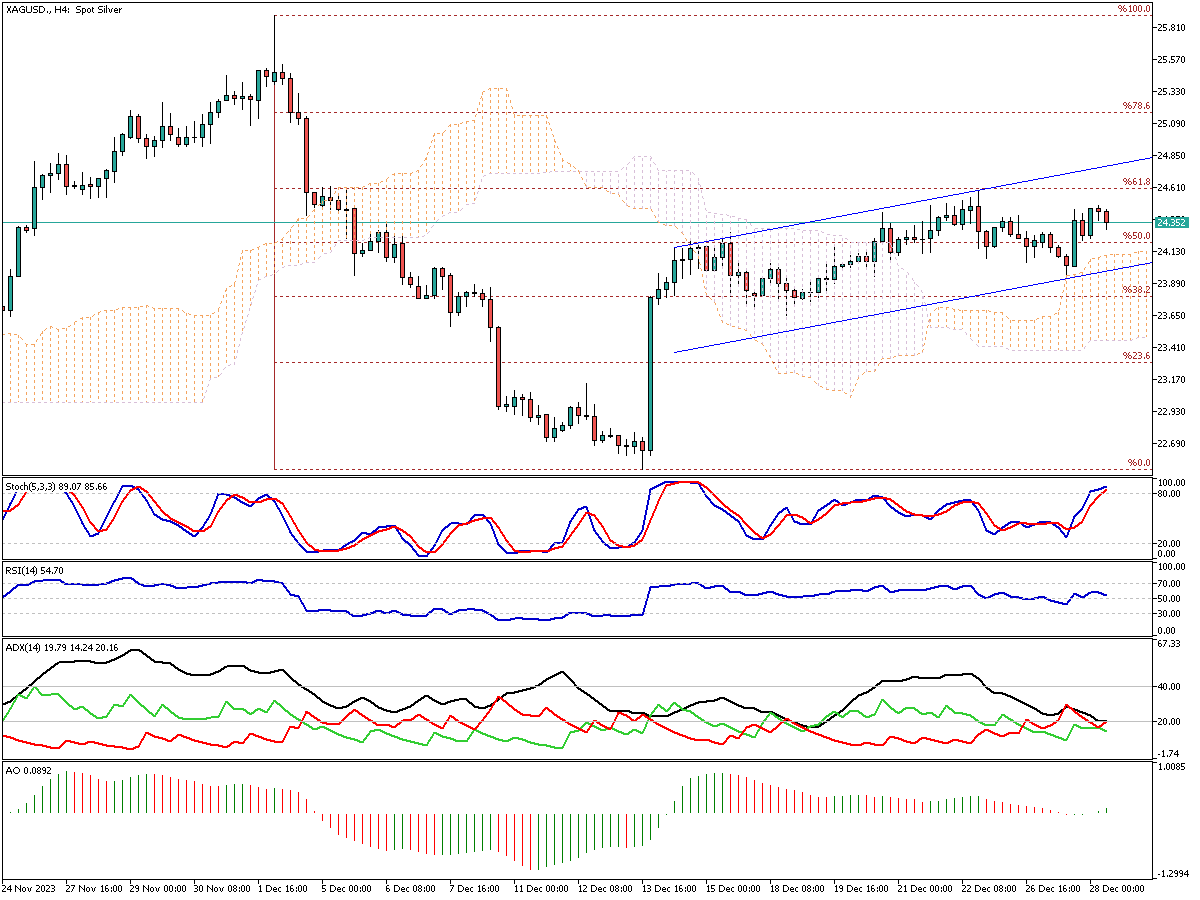

Silver Analysis – December-28-2023

Silver prices are currently hovering around $24 per ounce, indicating a potential close to 2023 with a 2.4% increase. This modest rise in the silver market is primarily attributed to the weakening dollar and decreased yields. Recent data from the US and Europe has reinforced the expectation that major central banks will begin reducing interest rates early in 2024.

In a climate of lower interest rates, the allure of non-yielding assets like silver tends to increase, enhancing its appeal and industrial demand prospects.

Moreover, the value of silver is bolstered by limited stocks at COMEX and LBMA, with the green economy’s demand consistently surpassing supply. The Metals Focus team anticipates a deficit of 140 million ounces (or 4,354 tonnes) in the silver market for 2023. Notably, silver prices hit their peak for the year at $26 on May 4th amid concerns regarding instability in the banking sector. Additionally, the year’s final quarter saw silver’s rally driven by geopolitical tensions in the Middle East and a more dovish stance from the Federal Reserve.