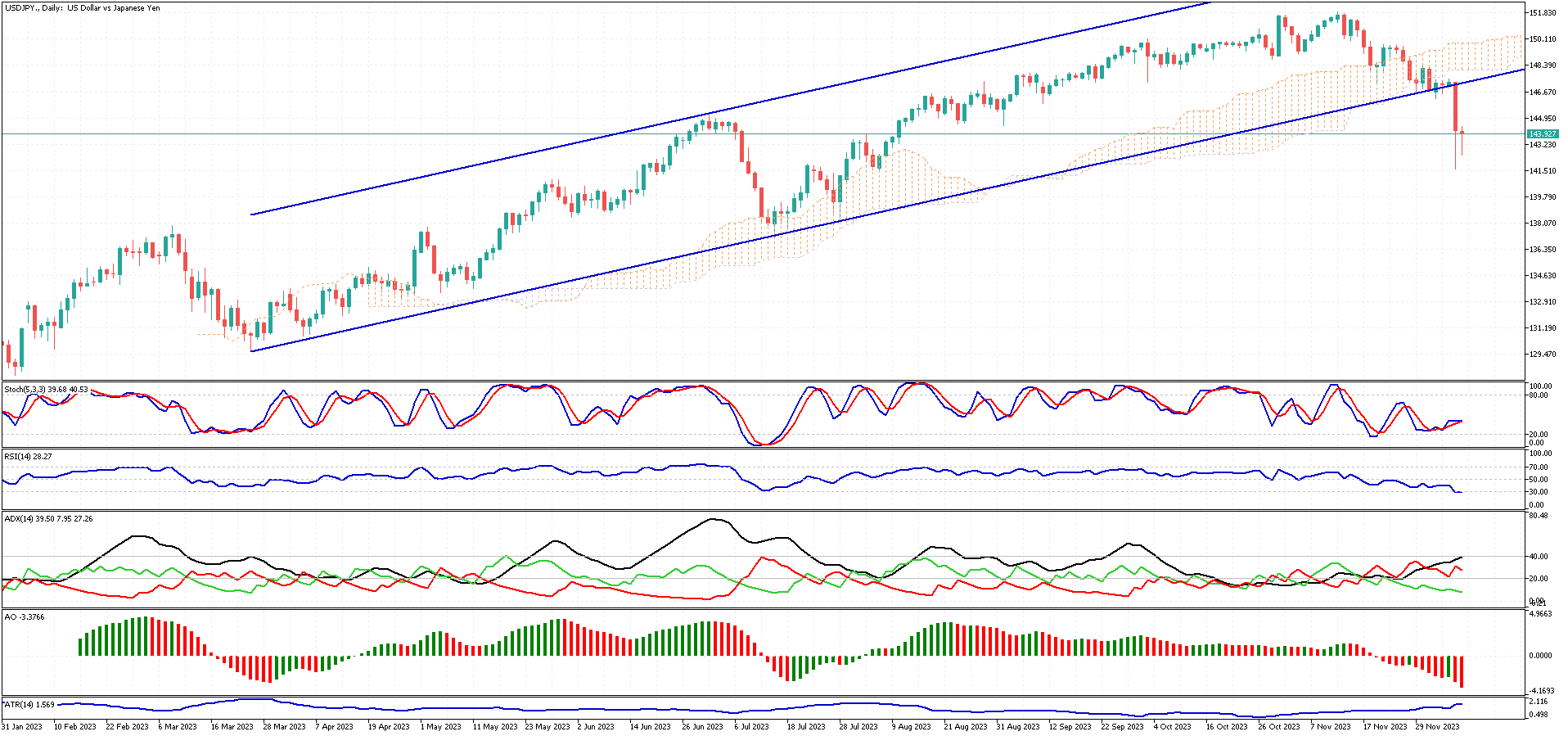

USDJPY Analysis – December-8-2023

USDJPY Forecast – On Friday, December 8, there was a slight decrease in the USDJPY, with the currency pair dropping by 0.126 or 0.09%, settling at 143.99. This was a minor fall from its previous level of 144.12 in the last trading session.

Looking at the forecasts from Solid ECN, our global macro models and analysts’ expectations suggest that the Japanese Yen might trade at around 149.34 by the end of this quarter. Peering further into the future, we estimate that in 12 months, the Yen could be trading at approximately 157.27.

Policy Change Hints Trigger Drop in the Japanese Share Market

Bloomberg – On Friday, Japanese stocks witnessed a downturn, with the Nikkei 225 Index dropping 1.68% to close at 32,308 and the broader Topix Index decreasing by 1.5% to settle at 2,324. This decline brought these indices to their lowest points in nearly a month. The fall in the stock market is primarily attributed to comments made by Bank of Japan Governor Kazuo Ueda. In a recent parliamentary session, Ueda hinted at a potential early departure from the long-standing hostile interest rate policy. He discussed various approaches to exiting the current ultra-easy monetary policies, emphasizing that future rate increases would be contingent on upcoming economic and financial conditions.

Investors were also influenced by new data indicating that Japan’s economy contracted by 0.7% quarter-over-quarter in the third quarter. This figure is a sharper decline than the preliminary estimates of a 0.5% contraction and follows a revised 0.9% growth in the second quarter.

Several major companies in the index suffered significant losses. Toyota Motor’s shares fell by 4.1%, Fast Retailing by 2.9%, Sony Group by 1.1%, Japan Tobacco by 2.2%, and Keyence by 1.7%.