GBPUSD Analysis – November-17-2023

The British pound recently climbed past $1.24, approaching its two-month peak of $1.2505 on November 14th. This rise indicates a potential weekly increase of more than 1% against the US dollar. This upward trend comes amid speculations that the US Federal Reserve might delay raising interest rates for now.

Economic Factors Influencing the Pound

Recent economic reports have shown some unexpected shifts. For example, UK retail sales decreased by 0.3% last month, which was a surprise since experts predicted they would grow by the same amount. At the same time, the rate at which prices rise in the UK (inflation) has slowed. This is the lowest since October 2021, with a 4.6% increase last month. These developments have led people to think that the Bank of England might consider lowering interest rates sooner than they had felt next year. Traders are now betting that interest rates could be reduced by about 80 basis points (0.8%) by the end of 2024. This is a more significant drop than the just over 50 basis points (or 0.5%) predicted a week ago. The current interest rate is 5.25%.

GBPUSD Technical Analysis

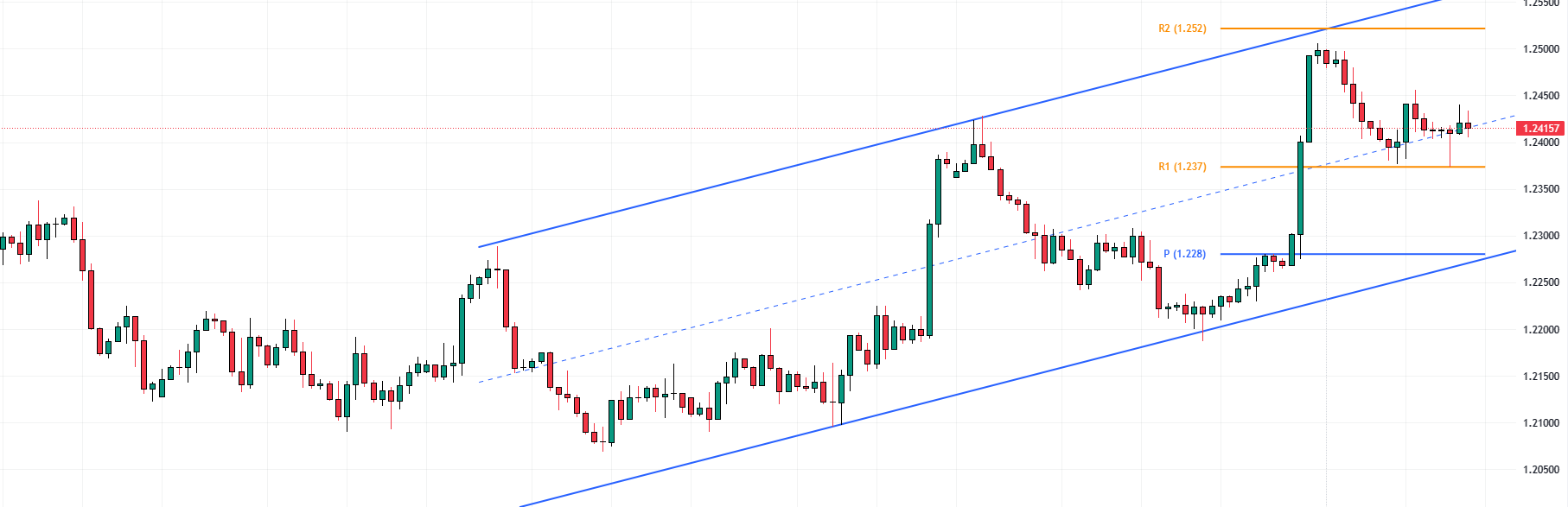

The bearish pressure on the GBPUSD pair eased at the R1 resistance level, coinciding with the median line of the bullish flag. A hammer candlestick pattern has emerged on the GBPUSD 4-hour chart, signaling that the market might be poised to resume its upward trend. Analysis of the data from the chart suggests that the momentum is likely to aim for the R2 resistance level again.

GBPUSD Technical Analysis

The 1.237 level supports the bullish scenario. Should this support level be breached, the decline that started on November 15th is expected to continue, with the 1.228 pivot point as the initial target.