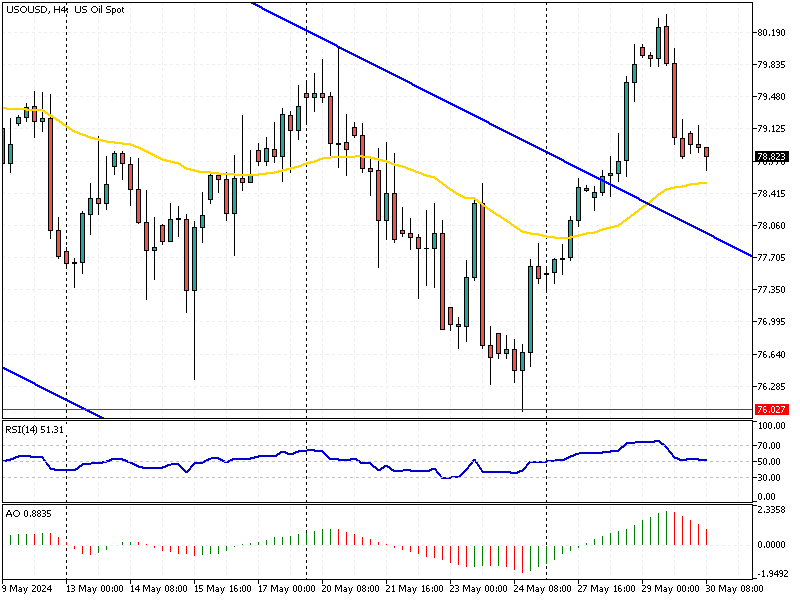

WTI Crude Oil Analysis – May-30-2024

WTI crude futures held near $79 per barrel on Thursday after losing nearly 1% in the previous session. This dip was influenced by growing expectations that borrowing costs might remain higher for longer, potentially hurting the demand outlook. As a result, commodities and other risk assets sold off while bond yields surged.

WTI Crude Oil Analysis – May-30-2024

WTI Crude Oil Analysis – May-30-2024

On Wednesday, traders bet the US Federal Reserve might delay starting an easing cycle or decide not to reduce rates this year. These speculations caused a ripple effect in the market, impacting the prices of various assets, including crude oil.

Industry data revealed significant changes in US crude and gasoline inventories last week. Crude inventories declined by 6.49 million barrels, and gasoline stocks fell by 452,000. However, distillate stocks increased by 2.045 million barrels, indicating a mixed picture for fuel supplies.

Upcoming OPEC+ Meeting and Market Expectations

Investors are also closely watching the upcoming OPEC+ meeting on Sunday. The group is expected to maintain current supply cuts, but any deviation from this plan could pressure oil markets. The decision from this meeting will be crucial in determining the future direction of crude prices.