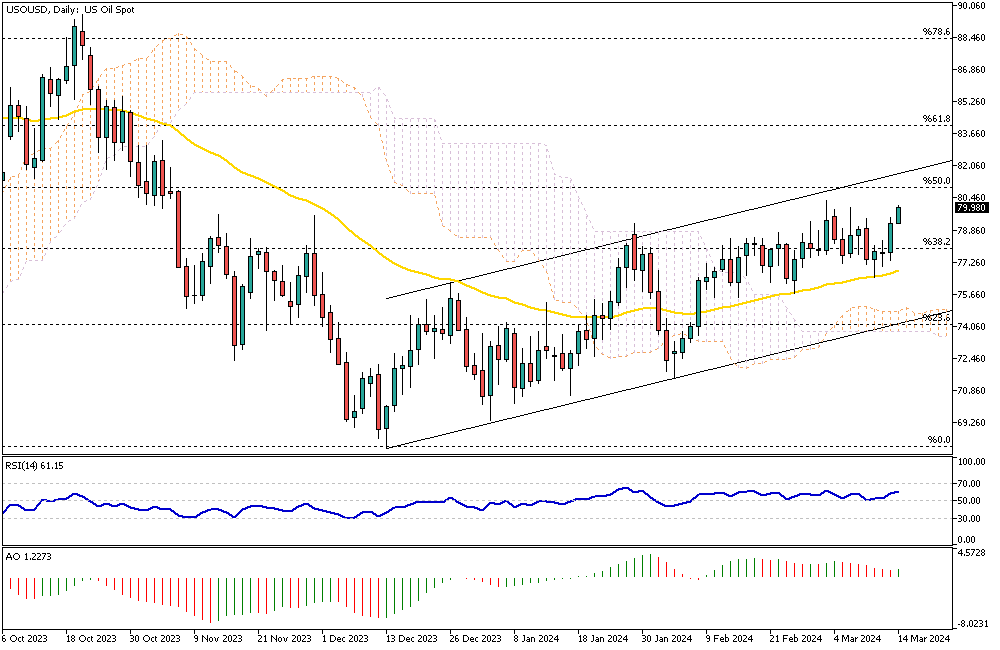

WTI Crude Oil Analysis – March-14-2024

In recent developments, the price of WTI crude futures has escalated, nearing the $80 per barrel mark. This significant rise marks the highest price point observed in over four months. The upward trend is primarily attributed to an unexpected decrease in U.S. crude inventories, indicating a robust demand within the world’s leading oil consumer.

Such a trend underscores the dynamic nature of the global oil market, where supply and demand factors constantly influence pricing and market stability.

Insights into U.S. Oil Inventory Dynamics

Contrary to market forecasts, there has been a notable reduction in U.S. crude stockpiles, with a decrease of approximately 1.536 million barrels last week. This movement defies the initial projections, which anticipated an increase of 1.338 million barrels. This marked the first reduction in nearly two months and aligns with earlier industry reports.

Furthermore, this decline was accompanied by decreased gasoline reserves and stockpiles at the Cushing hub in Oklahoma. These factors suggest a tightening market, with diminishing supplies contributing to the upward pressure on oil prices.

Global Events and Their Impact on Oil Supply

Global events continue to play a significant role in shaping oil market dynamics. Recent Ukrainian drone attacks on Russian refineries, notably damaging one facility, have added to the upward pressure on prices. Additionally, the ongoing geopolitical uncertainties in the Middle East and extended supply cuts by OPEC+ have heightened concerns about oil supply disruptions.

These developments underscore the complex interplay of geopolitical factors and supply considerations in determining oil prices, highlighting market participants’ need to stay informed and adapt to the evolving market landscape.