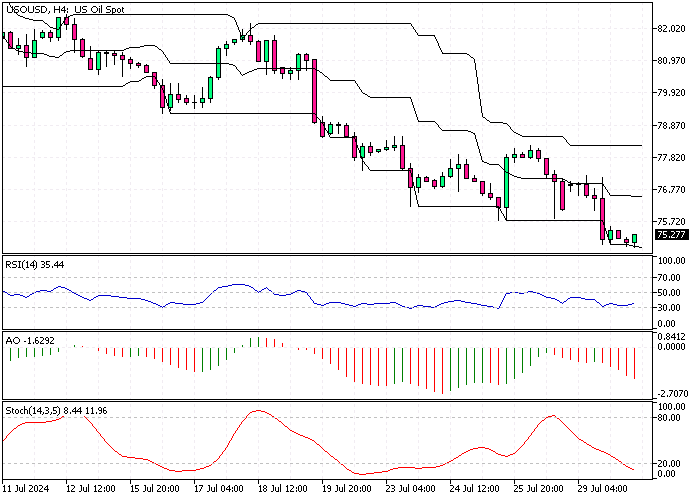

WTI Crude Oil Analysis 30-July-2024

WTI crude futures dropped to about $75.6 per barrel on Tuesday, marking the lowest point since early June. This decline is mainly due to ongoing concerns about demand from China, the world’s biggest oil consumer.

Data revealed that China’s fuel oil imports fell by 11% in the first half of 2024. This decline in imports has raised concerns about the overall health of China’s economy, especially after recent GDP figures were lower than expected.

WTI Crude Oil Analysis 30-July-2024

Furthermore, the People’s Bank of China (PBOC) unexpectedly cut interest rates last week to boost economic growth, which added to market worries.

In addition to the economic issues in China, geopolitical tensions in the Middle East have also influenced oil prices. Reports indicated that Hezbollah has started moving precision-guided missiles but does not intend to provoke a full-scale conflict with Israel.

This development has slightly reduced fears of an escalating war in the region. Meanwhile, the United States is leading diplomatic efforts to persuade Israel not to target major civilian infrastructure in Lebanon, aiming to maintain stability in the area.

For new readers, it’s essential to understand that crude oil prices are highly sensitive to global events. Economic indicators from significant consumers like China can significantly impact demand forecasts. Similarly, geopolitical tensions in oil-producing regions can influence supply expectations, affecting overall market stability. This combination of economic data and geopolitical developments is key to understanding the fluctuations in oil prices.