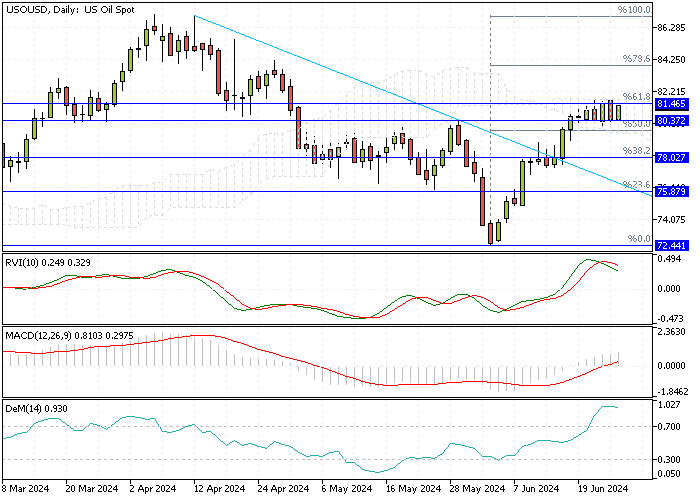

WTI Crude Oil Analysis – 26-June-2024

On Wednesday, WTI crude futures climbed above $81 per barrel, recovering some losses from the previous day. This rise occurred despite surprising data from the American Petroleum Institute (API) indicating a 0.914 million barrel increase in US crude inventories last week.

WTI Crude Oil Analysis – 26-June-2024

US Oil Demand Weakens Unexpectedly

This was contrary to market expectations of a 3 million barrel decrease, sparking concerns about weakening demand in the US, the world’s largest oil consumer. Additionally, US gasoline stocks surged by 3.84 million barrels, against predictions of a 1 million barrel decline.

US Energy Data Release Insights Today

Later today, the US Energy Information Administration (EIA) will release official data, providing further insights into these trends. Investors are also cautiously awaiting the US Personal Consumption Expenditures (PCE) inflation data, which could influence the Federal Reserve’s decisions on interest rate cuts.

Despite these uncertainties, oil prices remain close to two-month highs due to geopolitical tensions. Ukrainian drone strikes on Russian oil infrastructure and the lack of a peace agreement between Israel and Hamas have added to the market’s volatility.

Final Words

Staying updated on these developments is crucial for those involved in the oil market. Understanding the interplay between inventory data, geopolitical risks, and economic indicators can help make informed investment decisions and anticipate market shifts.