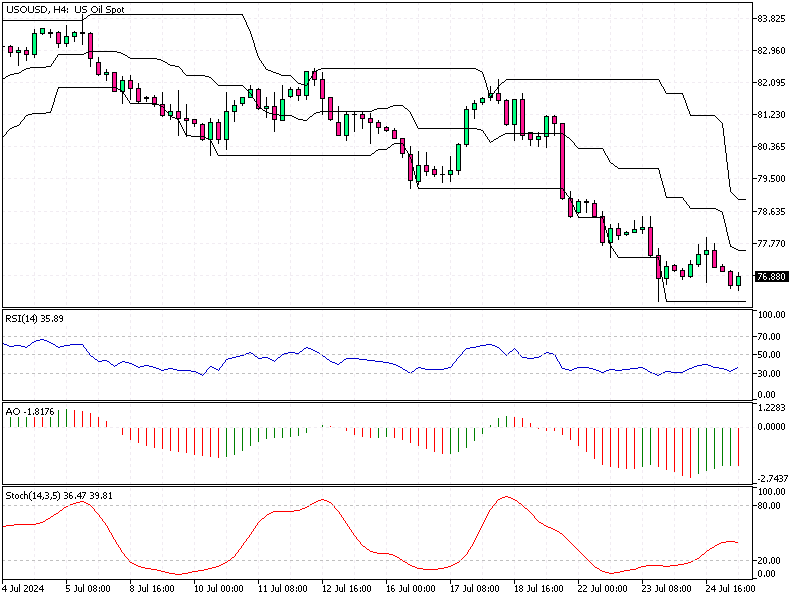

WTI Crude Oil Analysis 25-July-2024

On Thursday, WTI crude oil futures fell to around $77 per barrel, nearing their lowest point since early June. This decline happened because of the overall negative mood in global stock markets, which affected risky investments. In the U.S., technology stocks dropped sharply overnight due to disappointing earnings reports, causing a broader market decline.

WTI Crude Oil Analysis 25-July-2024

Furthermore, the likelihood of a ceasefire agreement between Israel and Hamas, with Egypt, Qatar, and the U.S. mediating, added to the downward pressure on oil prices. Another factor contributing to the drop in oil prices is the ongoing worry about weak demand from China, the world’s largest importer of crude oil. China’s economy has been slowing down, with its growth in the second quarter being just 4.7%, the slowest since early 2023.

In the U.S., the Energy Information Administration (EIA) reported a decrease of 3.74 million barrels in crude oil inventories last week, marking the fourth consecutive week of declines. This drop exceeded the expected 2.05 million barrel decrease, contributing to fluctuating oil prices.

For those new to the topic, it’s essential to understand that oil prices are influenced by a mix of factors, including global economic conditions, stock market trends, geopolitical events, and specific country demands. When technology stocks fall, as seen in the U.S., it often signals broader economic concerns that can lead to decreased confidence in investing in oil.

Similarly, geopolitical events, like potential ceasefires in conflict regions, can affect oil supply expectations, leading to price changes. Lastly, major oil-importing countries like China significantly impact global oil prices. When their economy slows down, their demand for oil drops, contributing to lower prices.