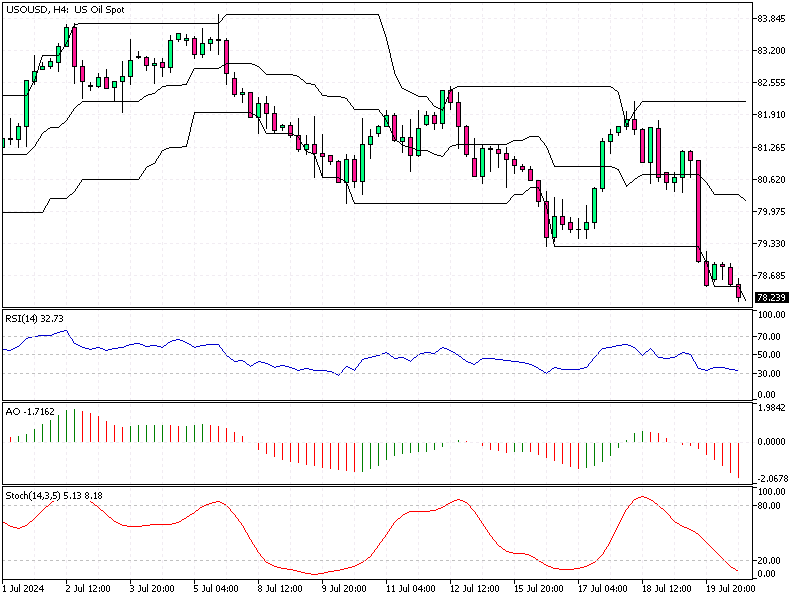

WTI Crude Oil Analysis – 22-July-2024

On Monday, the price of WTI crude oil futures stayed close to $79 per barrel. This price is near the lowest it has been since mid-June. The recent drop, over 3% in the last session, was influenced by several factors.

WTI Crude Oil Analysis – 22-July-2024

One of the main reasons for the drop is the hope for a ceasefire in Gaza. Last week, US Secretary of State Antony Blinken indicated that a much-anticipated truce between Israel and Hamas might happen soon. This news relieved the market, reducing the need to hold onto oil as a safe asset.

Another factor affecting the price is the stronger US dollar. When the dollar is strong, oil prices tend to go down because it becomes more expensive for other countries to buy oil. This leads to a decrease in demand.

There was also a broad selloff in risk assets, which included stocks and commodities like oil. This selloff was partly due to worries about China’s economic future. China is a significant oil consumer, so any concern about its economy can impact oil prices.

Despite these factors, some issues keep oil prices from falling too much. One of these is the short-term supply problem caused by wildfires in Canada. These fires threaten oil production, which could reduce the supply and keep prices higher.

Additionally, there is speculation that the US might start cutting interest rates as early as September. Lower interest rates can stimulate economic growth, leading to higher demand for oil.

Meanwhile, investors are also considering the political landscape in the US. President Joe Biden has ended his reelection campaign and supports Vice President Kamala Harris. This political change adds another layer of uncertainty to the market.

Final Word

In summary, while many factors are pushing oil prices down, such as hopes for a Gaza ceasefire, a strong dollar, and economic concerns in China, supply issues and potential interest rate cuts are also helping to keep prices from falling too much.