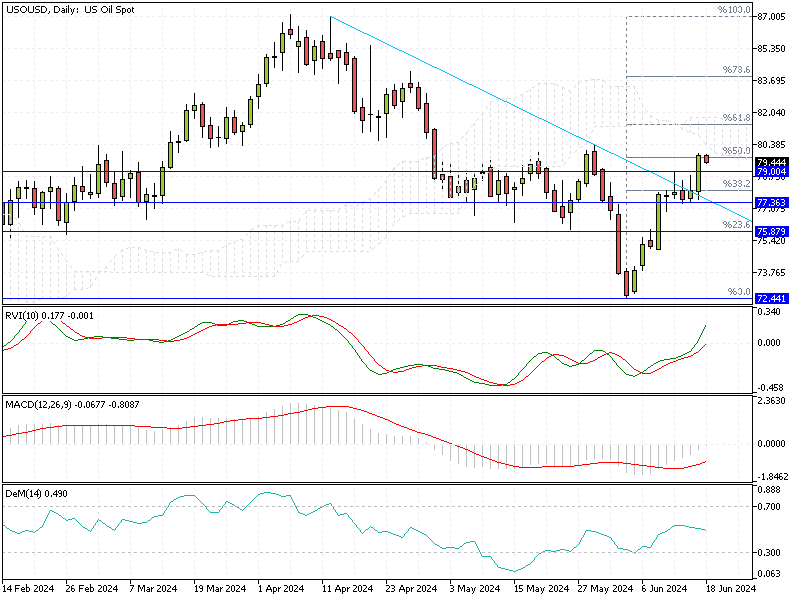

WTI Crude Oil Analysis – 18-June-2024

WTI crude futures held steady above $80 per barrel on Tuesday, maintaining the gains in the previous session, where prices increased by nearly 2%. This surge is driven by a positive outlook on global oil demand and expectations that major oil producers will continue to limit supply.

The US oil benchmark has been trading near its highest levels since late April, reflecting confidence in the market.

WTI Crude Oil Analysis – 18-June-2024

Oil Demand Growth Predicted to Surge

Recent reports from OPEC, the International Energy Agency, and the US Energy Information Administration all forecast strong oil demand growth in the latter half of this year. This optimism is bolstered by a broad rally in risk assets, fueled by easing inflation pressures in significant economies.

As inflation cools, there is growing hope for interest rate cuts in the coming months, which would support the upward trend in oil prices.

Russia and Iraq Support OPEC+ Quotas

On the supply side, key OPEC+ members, including Russia and Iraq, have reiterated their commitment to production quotas, ensuring that supply remains tight. Additionally, Saudi Arabia has signaled a readiness to adjust its output in response to market conditions, highlighting their proactive approach to managing supply.

Summary

Understanding these dynamics is crucial for consumers and investors. The sustained high prices of WTI crude could impact fuel costs and inflation, influencing economic decisions at both individual and business levels. Staying informed about these trends helps make better financial choices amid fluctuating market conditions.