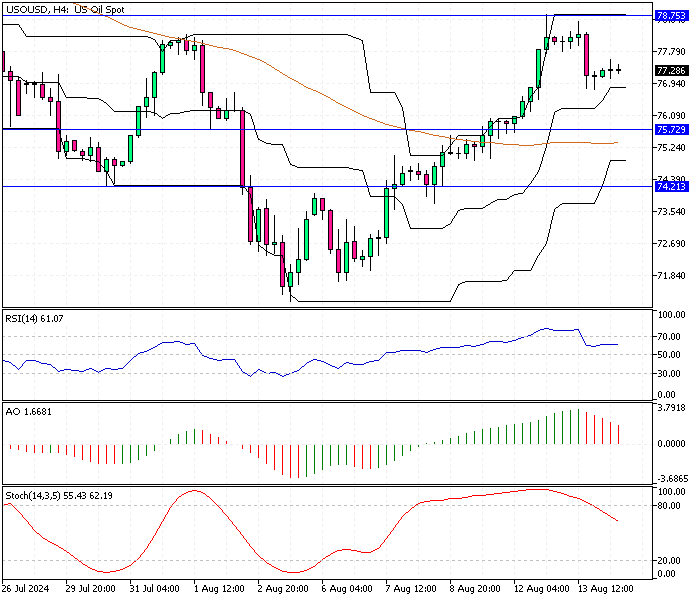

WTI Crude Oil Analysis 14-August-2024

by InkWell August 14, 2024 · WTI Crude Oil Analysis / Commodities

WTI crude oil futures climbed back to around $79 per barrel on Wednesday, recovering from the previous day’s losses. This rebound was mainly due to a significant drop in US crude inventories.

WTI Crude Oil Analysis 14-August-2024

WTI Crude Oil Analysis 14-August-2024

FxNews—According to API data, crude stocks fell by 5.205 million barrels during the week ending August 13th, which was much more than the expected 2.0 million barrel decrease and was the most significant decline since late June.

Ongoing concerns about potential oil supply disruptions in the Middle East helped keep prices elevated. As tensions rise, the market is closely watching the situation, with Iran expected to respond to Israel after dismissing Western appeals for restraint.

On the demand side, the IEA kept its forecast for oil demand growth below 1 million barrels per day for 2024 and 2025, pointing to weak consumption in China as a contributing factor.

Investors are also looking ahead to Wednesday’s release of US CPI data, which could affect the Federal Reserve’s approach to monetary policy. Potential rate cuts might boost economic activity and increase oil demand.

Tags: WTI CRUDE OIL