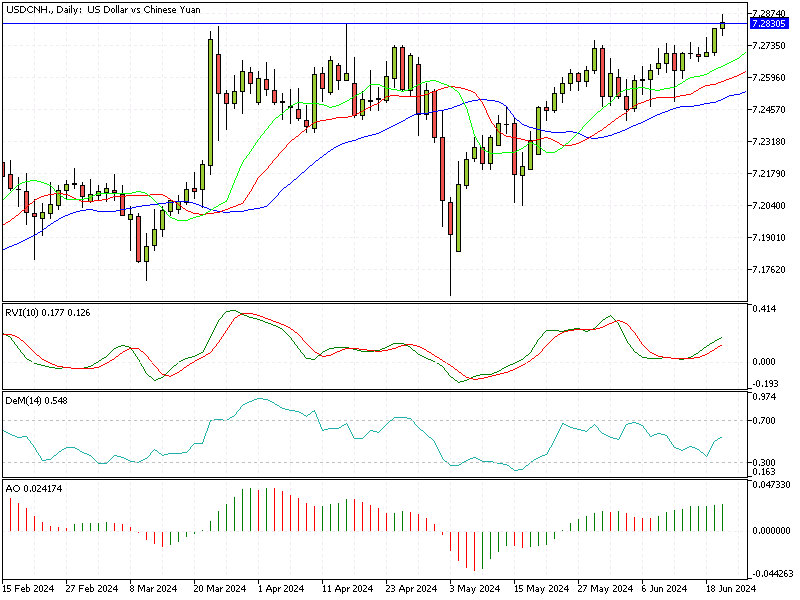

USDCNH Analysis – 20-June-2024

USD/CNH—The offshore yuan recently fell below 7.28 per dollar, marking its lowest value in over seven months. This decline follows a notable decision by the People’s Bank of China (PBoC) to set a significantly weaker official guidance rate. The PBoC set the midpoint rate at 7.1192 per dollar, the lowest rate since November 2023 and the most significant single-day move since mid-April.

This adjustment was necessary to prevent tomorrow-next trades from breaching the lower limit of the trading band at market opening.

USDCNH Analysis – 20-June-2024

USDCNH Analysis – 20-June-2024

Earlier in the week, China kept key lending rates unchanged during the June fixing, aligning with market expectations. The 1-year loan prime rate (LPR) was maintained at 3.45%, and the 5-year LPR remained steady at 3.95%, both at historical lows. These rates were last adjusted in February, with a record 25 basis point cut, highlighting the ongoing fragile state of China’s economic recovery.

The decision to maintain these rates underscores the delicate balance Beijing is trying to achieve. Despite the weak yuan, the unchanged rates suggest a cautious approach to monetary policy. This scenario reinforces calls for additional support measures to bolster the economy. Observers should closely monitor these developments, as they offer critical insights into China’s economic strategies and their potential global impact.