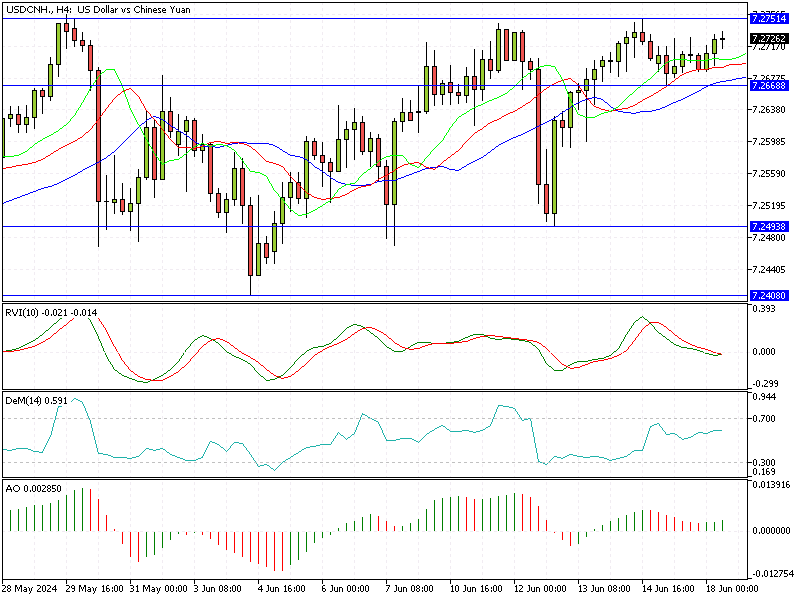

USDCNH Analysis – 18-June-2024

USD/CNH—The offshore yuan recently weakened to over 7.27 per dollar, reaching a nearly three-week low. This decline is mainly due to mixed economic data from China.

Reports on Monday showed that industrial production did not meet expectations, and the property sector continued to struggle, increasing the pressure on Beijing to implement measures to boost growth. On a brighter note, retail sales exceeded forecasts, thanks to a holiday-related increase in spending.

USDCNH Analysis – 18-June-2024

PBOC Strengthens Yuan Amid Weak Economy

Despite the overall weak economic performance, the People’s Bank of China (PBOC) offered some relief by setting the midpoint exchange rate at 7.1148 per dollar, much more robust than predicted. This move indicates the central bank’s intention to stabilize the currency and provide some confidence to the market.

US Retail Sales Data and Economic Insights

Investors are also monitoring important economic updates from the United States. Key data to be released includes retail sales figures expected later today, weekly jobless claims on Thursday, and preliminary Purchasing Managers’ Index (PMI) data on Friday. Additionally, several officials from the Federal Reserve are scheduled to speak at various events, which could provide further insights into the economic outlook.

Summary

In summary, while the offshore yuan faces challenges due to mixed economic signals from China, the PBOC’s actions and upcoming U.S. economic data will play crucial roles in shaping the currency’s future trajectory. Staying informed about these developments is essential for making well-informed financial decisions.